One of the nation’s largest solar developers approached a national grocery store chain about going solar. When it came time for the final pitch, the developer highlighted the ~150 locations that offered the biggest payback from installing solar. The customer thought the numbers looked good, but didn’t quite believe that the 150 locations were the best. He suggested one of his facilities in the California Central Valley, noting the ample sun in that location. The developer immediately pulled up the analysis for that site, noting the unfriendly tariffs and a rooftop filled with HVAC units and skylights. This is when the customer realized that the developer had done a detailed analysis for each location across the entire country, nearly 1,000 different buildings. “Their jaw dropped,” said the developer’s head of sales. “That was the moment we won the sale.”

This example is a classic case of a portfolio sale. The key elements of a portfolio sale are to break up the customer’s holdings into separate pieces and evaluate each of them individually. As a result, you can determine the subset of the projects that make the most sense and prioritize them above the others. In other words, you are turning down work if it doesn’t make financial sense for the customer. This builds credibility, by showcasing the fact that you are optimizing for customer value rather than your own revenue.

This example is a classic case of a portfolio sale. The key elements of a portfolio sale are to break up the customer’s holdings into separate pieces and evaluate each of them individually. As a result, you can determine the subset of the projects that make the most sense and prioritize them above the others. In other words, you are turning down work if it doesn’t make financial sense for the customer. This builds credibility, by showcasing the fact that you are optimizing for customer value rather than your own revenue.

This approach also lets you tease out what the customer’s financial objectives are. In many cases, they will want the greatest return (i.e. the greatest profit margin). However, in some cases, they may have additional money to use. If so, you can then showcase a different solution for maximum net present value (NPV) or maximum revenue (which will typically be very different results from the maximum profit margin solution).

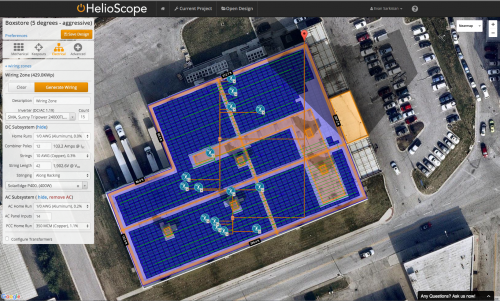

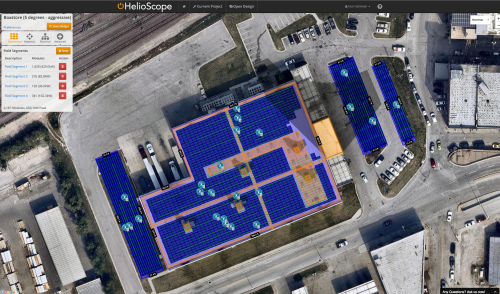

Developers are increasingly responding to portfolio opportunities using this technique. Advanced software design tools make it easy to evaluate hundreds of projects in the time it used to take to evaluate just a few. In the example described above, the developer used HelioScope to model each of the 1,000 potential buildings–a process that would have been impossible just a few years ago.

What this looks like

This technique can take different forms, depending on the customer. For example, with residential customers, you might break up their rooftop into different sections and structure the conversation around the total potential of their rooftop, versus the sections that make the most financial sense to build.

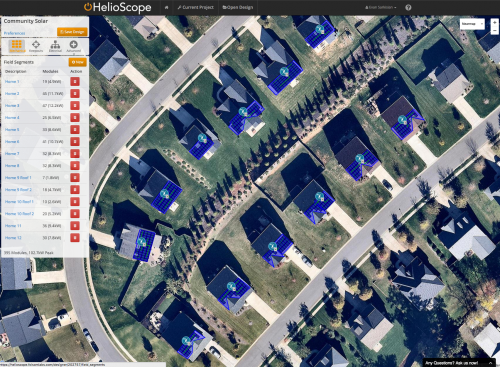

Alternatively, you could show their system in the context of their neighborhood, showing how their rooftop is better than their neighbors’ for installing solar. And if it isn’t, you can give them handouts to give to their neighbors for referrals!

Alternatively, you could show their system in the context of their neighborhood, showing how their rooftop is better than their neighbors’ for installing solar. And if it isn’t, you can give them handouts to give to their neighbors for referrals!

With small businesses, try to find if the landlord owns other buildings (you can often find this from property tax information). Then you can turn their group of buildings into a small portfolio exercise. This is a great way to turn a lead on a single building into a much bigger opportunity, while at the same time establishing trust with the landlord through a much more nuanced discussion.

Finally, even for single commercial properties, think of the entire area as a portfolio of sites. What is the ROI on a carport canopy? What is the potential value of a ground-mount array at the side of the building? This not only helps to maximize total ROI but also helps get the owner or facilities manager thinking more creatively about how best they can install solar.

Advantages and Disadvantages

The main advantage to this approach is that winning a portfolio of projects can have a dramatic impact on a company’s bottom line. It’s more than just a big boost to revenue–having one main negotiation can mean significantly reduced customer acquisition costs. It can also give you the flexibility to stage out the installation process to keep costs low.

The main advantage to this approach is that winning a portfolio of projects can have a dramatic impact on a company’s bottom line. It’s more than just a big boost to revenue–having one main negotiation can mean significantly reduced customer acquisition costs. It can also give you the flexibility to stage out the installation process to keep costs low.

The main downside is that this approach certainly requires more preparation–often much more, since you’ll have to research the other locations in the owner’s portfolio and then do detailed analysis for each property. But it can often pay off with the combination of a larger potential transaction and improved close rates.

Paul Grana is the co-founder and head of sales & marketing for Folsom Labs.

Read method three, “The Personalized Sale,” here.

Read method two, “The Optimization Sale,” here.

Read method one, “Collaborative Selling,” here.

Read more Solar Boot-up articles from Folsom Labs here.

Tell Us What You Think!