How do you build a healthy solar business in a constantly changing market? Solar businesses have had to confront the effects of tariffs, changing incentives and many other new drivers of demand, which creates both opportunities and challenges for solar software. At the 2018 Solar Software Summit, MJ Shiao, formerly of Wood Mackenzie Power & Renewables; and Paul Grana, of Folsom Labs; both took a deep look into how the industry has been affected by these changes, and how businesses can continue to thrive by using solar software.

As MJ pointed out, the solar industry had a dim outlook entering 2018. Slowdowns were expected with the expected expiration of the ITC, and tariffs on solar modules also contributed to a slight decline in the market. Distributed solar was losing steam after years of record growth, and many solar installers stagnated or shrunk as well. Small commercial solar was expected to fade as its incentives disappear, and utility solar demand had begun to contract as well.

Despite all of these threats to solar, the industry has actually been proving itself resilient. California remains a “bedrock” market, while other states like Texas and Florida are emerging as new sources of growth. Recent news of new renewables targets in the Midwest shows us that demand is only further growing. In addition, MJ noted that utility solar was starting to beat out other utility scale power installations, even beating out new natural gas plants.

Finally, solar developers are learning to unlock the full asset value, including avoided distribution costs, and locational benefit of solar. As a result, “in the next five years, we are going to see the U.S. solar capacity double, to 100 MW.”

Evolution of solar software

What does all of this mean for solar software applications? It can be difficult to determine what the future of solar software should be with a shifting market, but Paul pointed out that we can take lessons from software products’ evolution in other industries.

Early software products were delivered as monolithic applications. One source and one business for everything you needed, from start to finish. Companies like Microsoft and Oracle owned the entire spectrum of internal tools that a business needed. If you wanted one part of the program, you still had to purchase most or all of what their solutions offered.

Later, with the integration of the cloud, services could focus on tight vertical niches, such as sales, marketing or HR. Businesses only had to purchase the software products they wanted to use that were dedicated to the problems they needed to solve. In this phase, companies specialized in functional areas, such as Salesforce for CRM or Workday for HR software solutions.

Finally, the most recent step is the further unbundling of software products. Rather than providing a comprehensive software product for an entire organization, products are focusing on a specific use case or application. Paul showed the fragmentation of marketing tools as an example: instead of a single marketing program, you may use Twilio for SMS messages, Algolia for in-app searches and MailChimp for email marketing.

Unbundling programs means that end-users have even more control over what areas of their product they want to build, and what they can buy as an existing solution. This also means that the vendors developing these solutions can be more focused on delivering a quality product that is easy to integrate into an existing business.

To come back to how this relates to solar, Paul noted, “…the trend is not toward one solution to rule them all. The trend is not toward M&A and consolidation so that you have one vendor. The trend is toward many vendors, and that allows the buyers to more effectively get what they want.” Differentiation is what allows the solar industry to actually stay healthy and adapt to the constantly changing regulatory environment. If all solar developers sold the same systems, we would charge down the path to zero margins on projects. By differentiating, solar doesn’t have to sacrifice margins for the sake of closing a deal.

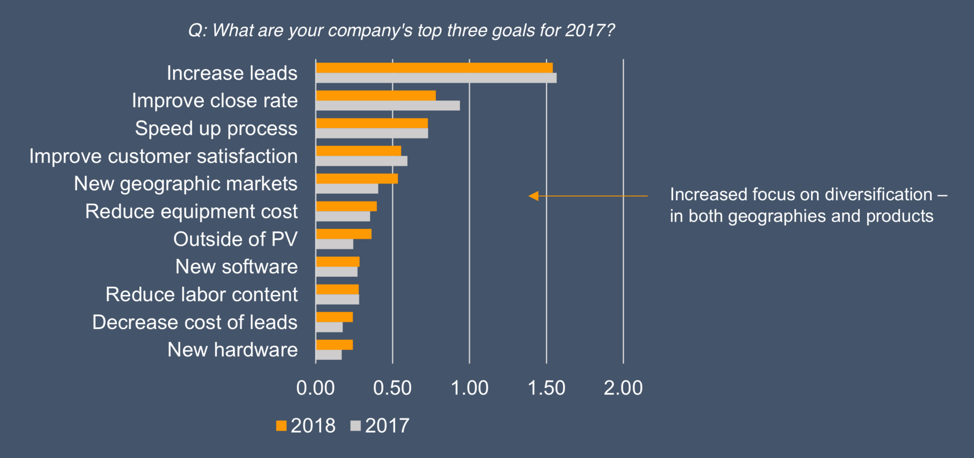

The 2018 Folsom Labs and Wood Mackenzie Power & Renewables solar survey reflected this theme in the analysis. Solar companies continued to focus on growth and ramping up the speed of business as the top ways to improve.

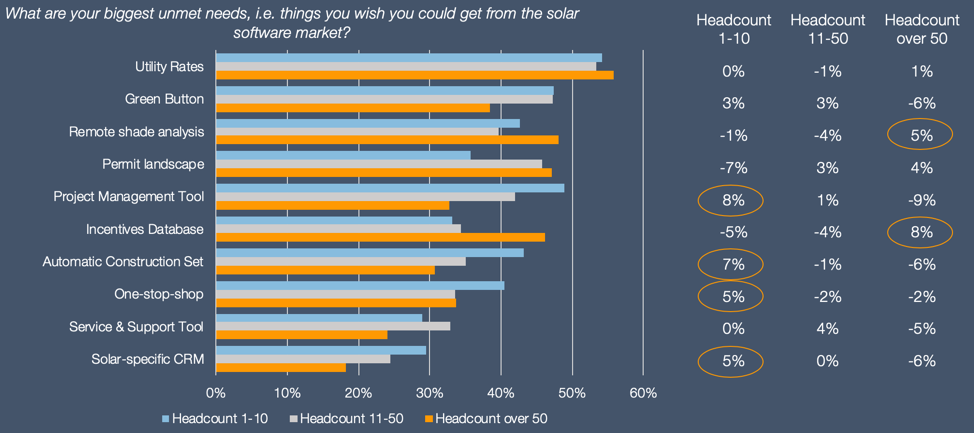

On another encouraging note, the ways that large and small companies wanted to improve their business was entirely different, with large companies focusing on more technical elements like shade analysis and financial incentives, and small companies focusing on project management and permitting. This difference supports the need for different types of solar software that address the entire workflow for companies both large and small.

There are challenges facing the solar industry, but our diversity (in both developer business model and software products) makes us well-positioned to adapt.

Want to be a part of discussions like this? Join Folsom Labs and over 100 leading solar developers and software companies at the 2019 Solar Software Summit, May 13 in San Diego.

Tell Us What You Think!