In Northwest Ohio sits a railway town that can trace its foundation to the boom of the locomotive in the early 1800s. Named after local railway engineer James Bell, the city of Bellevue is today home to the largest rail yard on the Norfolk Southern system. Moorman Yard is the junction of five routes heading in all major directions, and industrial parks surround the site for easy access to freight lines.

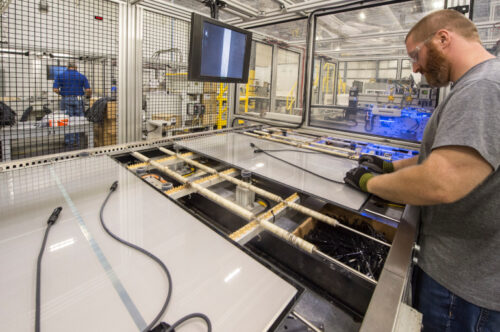

Just to the west of the vast rail hub is a 200,000-ft2 warehouse with an 80,000-ft2 climate-controlled “building within a building.” It’s here where four shifts of employees churn out product faster than they can ship. This is H.B. Fuller, the only domestic manufacturer of EVA sheets — an essential product for every type of solar panel made today.

“We’re not waiting [for final Inflation Reduction Act credit rules]. We’re committed to growing our business and growing it now,” said David McDougall, senior business development manager for PV at H.B. Fuller, on a recent Solar Power World visit to the Ohio manufacturing plant.

The solar encapsulant factory opened in July 2021 and has already almost doubled in size, with plenty of negotiating power to quickly expand further within the warehouse. H.B. Fuller makes ethylene-vinyl acetate (EVA) and polyolefin elastomer (POE) encapsulants that laminate solar cells, providing a moisture barrier before solar panels are finished with glass and backsheets at final assembly. Without the encapsulant, solar cells would float freely behind the glass.

Being the only EVA (the more popular and cost-effective of the two encapsulants) manufacturer in America was already a strong selling point for the growing U.S. module assembly industry, but the product became even more important to the domestic manufacturing conversation when the IRS included encapsulants as one of the subcomponents necessary for a solar panel to qualify for “domestic content” tax credits. Under incentives included in the Inflation Reduction Act (IRA), non-residential solar projects can receive a bonus credit if their products meet certain manufacturing requirements. For solar panels specifically, American manufacturers using American-made solar cells, frames, back rails, glass, encapsulants, backsheets, junction boxes, edge seals, pottants, adhesives, bus ribbons and bypass diodes would easily qualify for the full domestic content adder.

While the biggest beneficiary is the tax-paying entity that owns the project and can claim the domestic content bonus, Baker Botts partner Eli Hinckley said everyone in the solar project chain is interested in securing that “Made-in-USA” distinction.

“The person who’s going to own the asset is the person who cares the most. The other person that cares a lot is the tax equity [investor], because they understand what their investment will be based on [additional credits]. Lenders care because that will provide the economic base for calculating the loan amount. EPCs care because it affects their pricing. The actual manufacturers care because it materially impacts what your selling price is going to be and what the demand for your product will be,” he said. “This is core to how everyone is thinking about value creation.”

While the details around what truly makes a domestic solar panel are still a bit sticky (is it all 12 of the mentioned subcomponents or a simple majority?), if there was ever a time for U.S. solar panel assemblers to Americanize their bills of material, it’s now. Domestic subcomponent makers are ready to make that happen.

Making deals

Exclusive deals in U.S. solar panel production are already flying. Hanwha Group has been securing its place as the most domestic silicon solar panel manufacturer it can be, with Korean backing. The entirety of REC Silicon’s American polysilicon supply will go to Hanwha’s Qcells ingot, wafer, cell and panel manufacturing operations in Georgia. The group will also be behind the country’s second EVA factory once it opens next year. Its subsidiary Hanwha Advanced Materials Georgia will establish EVA sheet manufacturing near the Qcells solar panel plants. The entirety of Hanwha’s EVA capacity is expected to go to Qcells’s American operations. (Update: Hanwha informed SPW that it will supply EVA to the larger market, with Qcells being one of its customers.)

NREL archive photo of junction box and wire assembly on First Solar Series 4 modules in the company’s Ohio manufacturing plant.

Meanwhile, the country’s first domestic junction boxes will be made in Texas for one solar panel company. Houston-based solar panel assembler SEG Solar recently penned an agreement for American-made junction boxes with Chinese enterprise UKT New Energy. UKT will start a new factory in Texas to supply junction boxes exclusively to SEG.

“America’s solar company” First Solar has actively been domesticating its supply chains, making deals for American steel, copper mining and glass for its CdTe thin-film solar panels. First Solar entered an agreement with Vitro to restart an idled manufacturing line in Pennsylvania to exclusively make float glass for the specialty panels. Vitro had previously made glass for downstream automotive-glass finishing plants on the line, but a combination of events led to its shutdown in 2020. First Solar’s order will allow Vitro to hire 130 full-time workers after investing $93.6 million to update the line for solar needs.

“Vitro is making these investments because we see the great potential of the solar industry. As an ‘onshore’ float glass manufacturer, Vitro has the history, resources and technological capability to contribute to improving solar performance in the United States and beyond,” said Paul Bush, VP of technical services and government affairs for Vitro Architectural Glass.

Room for everyone

These exclusive subcomponent supply agreements will provide solar panel companies with the easiest route to meeting domestic content requirements. Third-party verification will likely increase in the coming years, Baker Botts’s Hinckley said, so manufacturers can have credibility without opening their books. But so much more subcomponent manufacturing is needed than what is provided by these one-offs.

“The idea behind all of this was to try to build out the domestic manufacturing capacity for clean energy — we’ll create additional value if you meet these targets. We can support people building out new capacity, because there will be a premium for their products because you get this additional 10% tax credit,” Hinckley said. “You’re going to need multiple participants to support adequate domestic production.”

H.B. Fuller has no exclusive deals and is open to anyone. When asked if there was a minimum order-size limit the company would accept to supply some of the smaller U.S. panel assemblers, H.B. Fuller reps said that was up to how comfortable those companies were with limited-run pricing.

“We’re not turning away the small guys, because they will get big someday,” McDougall said.

U.S. backsheet manufacturer Endurans Solar is another company without exclusive supply agreements. The company (which can also receive a bonus 40¢/m2 manufacturing credit from the IRA) is increasing its manufacturing capacity in New Hampshire to meet domestic demand and should announce a second U.S. manufacturing site before the end of Q3. Endurans does make specialty backsheets for American panel companies like Silfab, but no single manufacturer can supply the country’s gigawatts of demand, so it’s keeping its doors open.

“We’re excited that many more millions of solar panels will be manufactured and installed in the U.S. over the coming years, and we look forward to supporting the growth of U.S. solar panel manufacturers with our high-performance, sustainable and made-in-America backsheets,” said Nathan Arbitman, president of Endurans Solar.

H.B. Fuller sees things the same. Its three manufacturing lines in Ohio have the capability of producing about 5 GW of encapsulants — barely one-fifth of the country’s expected panel manufacturing aspirations. It takes 40 minutes for H.B. Fuller to finish one roll of the polymeric material; it takes a solar panel manufacturer four hours to use up the same roll. The adhesives giant is producing as quickly as it can in Bellevue and there’s always the opportunity to make even more.

“We are excited about the growth opportunities created by the IRA and believe we are well-positioned to capitalize and support this growth as the American market sees a resurgence of investment and new solar production capacity across the board,” McDougall said.

Tell Us What You Think!