By Adam Gerza, COO of Energy Toolbase

Also see: Case Study II: Analyzing SCE’s new TOU rates with solar+storage

A historic thing happened earlier this month for residential energy storage economics. For the first time ever, the project economics of a solar-plus-storage project operated in time-of-use (TOU) arbitrage mode, beat the economics of a standalone solar PV project. This noteworthy occurrence happened in the Southern California Edison (SCE) service territory when SCE implemented its new TOU rate structures on March 1, 2019.

At Energy Toolbase, we have modeled the utility bill savings and project economics of energy storage system (ESS) projects operating in TOU arbitrage mode on hundreds of TOU rate schedules around the country. “TOU arbitrage mode” simply means utilizing an ESS to charge the battery when energy is cheap (“off-peak”), then discharge back when energy is expensive (“on-peak”). Just like arbitrage in the stock market, it means to buy low, sell high and capture the difference. On every residential rate schedule that we have modeled, adding ESS to a solar project erodes the economics of the project. In many cases adding storage weakens the financial return significantly.

California’s new TOU rates

The California Public Utilities Commission (CPUC) recently approved the big three investor-owned utilities (IOUs) to start transitioning residential customers onto time-of-use based rates. This was done to encourage conservation and provide a price signal for customers to shift usage from on-peak to off-peak hours. SCE’s new TOU rate designs went into effect on a voluntary basis starting on March 1 and all residential customers will default onto TOU rates in October of next year.

The IOU’s new time-of-use rate designs have been controversial. Solar industry advocates protested the new rate structures, which are radically different from the tiered-rate and TOU-rate designs that had previously been in effect. The most notable change in the new TOU rates is the dramatic shifting of the “on-peak” period to much later in the evening. The old legacy “on-peak” TOU window had previously been midday from noon to 6 p.m. The new rates shift the “on-peak” window to much later in the evening, to 4 to 9 p.m. (or 5 to 8 p.m. in some cases). Ironically, midday energy usage used to be the most expensive (“on-peak”); now it’s become the cheapest (“off-peak” or “super-off peak”). All three of the IOUs are implementing similar TOU window shifts.

The new rate designs are not friendly for solar. With the “on-peak” period moving later in the day, the value of solar gets eroded. Effectively most solar production gets revalued as cheap “off-peak” energy. Therefore, the utility bill savings that solar can achieve goes down; for many customers significantly. To ease this erosion effect, the CPUC has mandated grandfathering protections for existing solar homeowners in California. But there is a silver lining to these new rates. This bad news for solar is great news for storage, as these new TOU rate designs are very favorable for ESS economics.

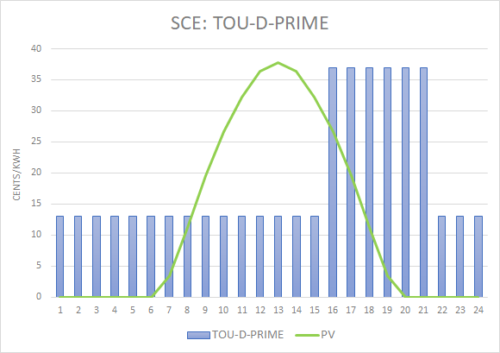

SCE’s new “TOU-D-PRIME” rate

SCE’s new “TOU-D-PRIME” rate

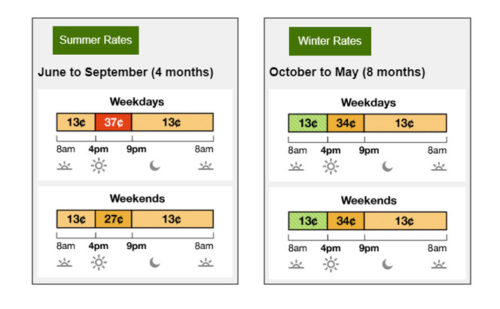

On March 1, SCE introduced a new optional rate schedule intended specifically for homeowners with energy storage: the TOU-D-PRIME rate. This TOU-D-PRIME rate has all the elements of an advantageous rate for ESS economics. The rate has a wide TOU price differential in both the winter and summer season: $24/cents/kilowatt-hour in the summer and $21/cents/kWh in the winter. Also, the PRIME rate offers this price opportunity all seven days of the week, rather than only Monday through Friday, which is typical of most residential TOU schedules. This strong price signal effectively allows an ESS to cycle all 365 days of the year, charging off-peak and discharging on-peak, and capturing a lucrative price difference. The TOU windows also happen to align perfectly for optimal ESS charging and discharging. “Off-peak” is 8 a.m. to 4 p.m., so the ESS can charge entirely from PV and be investment tax credit (ITC) compliant. “On-peak” is 4 p.m. to 9 p.m., so the ESS is incentivized to discharge at a time when residential customers have their highest energy consumption. If utilities in other parts of the country want to truly incentivize behind-the-meter residential energy storage, they should look to replicate the design of SCE’s TOU-D-PRIME!

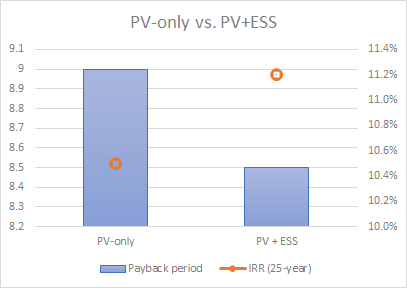

Our comparison analysis

Using Energy Toolbase, we modeled the project economics of a PV-only project, versus a solar-plus-storage project for a typical homeowner in the SCE service territory. We used reasonable market-rate assumptions, which are summarized below:

Customer assumptions:

- Annual usage: 12,000 kWh/year

- Customer load profile: NREL/OPEN EI, typical residential customer in Santa Ana, California

- Rate schedule: SCE, TOU-D-PRIME (effective date: 3/1/2019)

- Annual utility bill: $2,549

- Utility bill escalation rate: 3%

PV-only system:

assumptions:

- PV system: 7 kWdc

- PV production: 10,529/kWh (PV Watts v5)

- All-in installed price: $21,000 ($3/W)

- Incentives: Federal ITC (30%)

project economics:

- Year 1, utility bill savings: $1,492

- Payback period: 9.0 years

- 25-year IRR: 10.5%

PV+ESS system:

assumptions:

- All identical PV-only system assumptions +

- ESS hardware: (1) SolarEdge StorEdge Inverter + (1) LG Chem RESU10H battery

- ESS hardware specs: 5 kW max power, 8.3 kWh usable capacity (assumes 15% capacity set-aside for back-up)

- ESS software mode of operation: TOU arbitrage mode, ESS must charge from PV, ESS cannot export to grid

- All-in installed price: $11,000

- Incentives: ITC, SGIP (SCE, step 4)

project economics:

- Year 1, utility bill savings: $2,131 total ($639 from ESS)

- Payback period: 8.5 years

- 25-year IRR: 11.2%

*Notes & disclaimers: This analysis was run in Energy Toolbase using “TOU-D-PRIME” as both the before and after rate. The results were very similar when modeling with SCE’s residential rate schedule “D” as the before rate, and “TOU-D-PRIME” as the after rate. We ran this same analysis across a range of different solar PV system sizes (3 kW, 4 kW, 5 kW, 6 kW, 7 kW, 8 kW); in all cases the PV+ESS project economics beat the standalone-PV project economics. We spoke with multiple leading residential installation companies in California who install the StorEdge + LG RESU10H system to confirm that $11,000 for the total turn-key ESS installed cost is conservative.

In our example above, it’s important to point out that it’s a combination of factors that enables the PV+ESS economics to beat the PV-only. In addition to the storage-friendly TOU-D-PRIME rate, the ESS project economics are aided by: (i) the self-generation incentive program rebate (SGIP), (ii) the fact that we’re assuming the ESS qualified for the 30% federal investment tax credit, and (iii) the declining market rate cost of ESS hardware and installation.

The TOU-D-PRIME rate is an outlier. The reality today is that most residential rate schedules do not offer the ability for ESS to significantly reduce a consumer’s utility bill. Because of this, homeowners that have installed ESS have been motivated by non-financial reasons, such as having back-up power in the event of a grid outage, being more energy-independent and less reliant on their utility company, and also the cool factor of being an early adopter of a new technology that most believe will one day revolutionize the grid.

The U.S. residential energy storage market has already been growing steadily over the last couple of years, even without a strong financial use case. At Energy Toolbase we have always believed it would be a real inflection point in the market when adding storage to a solar project actually improves the project economics. We expect residential ESS deployments to ramp up aggressively in SCE now that this opportunity exists. Adding ESS to a PV project is a no-brainer for homeowners when it can improve their financial return, deliver back-up power, make them more energy independent, and give them bragging rights. We hope this historic occurrence gets replicated soon in other regional markets.

Apologies for this elementary question: PG&E says that NEM has my electric meter running forward when I draw energy from the grid and backward when I send energy to the grid, but does not explain how I get TOU credit for using my solar-storage system to draw energy when costs are low and provide it when its value is high. To do so requires that Net Energy VALUE (kWh x $/kWh) must somehow be metered and netted, rather than just Net Energy (kWh). Anyone know if and how this is done?

Also, if, at “true-up” I’ve provided more Energy, or more Energy Value, to the grid than I used, do I get a payment from PG&E or just a credit for the following year?

Tou-D-PRIME may be helpful for solar + ESS, BUT if you are also charging an electric vehicle (in my case, a Tesla), it falls flat on its face. I’m currently on the TOU-D-A plan which lets me charge at night for 14c/kWH, but pays me 56c/kWh for solar generation from 2PM until dark. The solar generation at the higher rate more than covers ALL of my usage charges including charging the Tesla and I’m getting a rebate check from SCE once a year instead of paying.

With the TOU-D-PRIME I am screwed out of more than half of those generation credits, receiving only 14c/kWH for 75% of my daily solar generation AND receiving only 41c vs 56c for the peak generation. AND on top of all of that, the Prime charges about $12 a month fixed fee, which TOU-D-A does not. So, stay on the TOU-D-A, right? WRONG! SCE is scheduled to rescind the grandfathered TOU-D-A rate schedule in about 2 years. Oh, and another piece of Calif. PUC skulduggery, I will only get the $2900 SGIP incentive (for the powerwall2) if I switch over to PRIME now. Damned if I do, damned if I don’t.

The current rate (someone correct me if I’m reading this link wrong) for recent SCE NEM customers only a few cents per kWh for power returned to grid, depending on the month, according to this link:

https://www.sce.com/regulatory/tariff-books/rates-pricing-choices/net-surplus-compensation

@Adam Gerza – this limited compensation seems to push new home solar to using batteries as you aren’t getting much back for excess power generated. Also with battery you become eligible for TOU-D-PRIME versus the default TOU-D-4-9PM

There is a movement, not just in California, but across the land and in places like Australia where average electricity rates are at the 25 cents per kWh now. We hear about TESLA and their power wall 2.0 and how cheap it is. Yet sketchy arrival dates and seemingly endless back peddling on full release of the product makes one look elsewhere. I have actually been able to look over a Sonnen ESS in a tract home development that installs some solar PV and a Sonnen 10kWh ESS in each home. The unit has the battery pack(s) installed and can be increased to a 20kWh system with 16kWh use and 4kWh emergency. The system has the 10kWh pack or about 7 to 8kWh use and a radian inverter to handle battery charging and smart grid technology to address the shifting peak rates to after solar PV hours.

Does this also pencil out if you have an existing solar system and decide to add storage? Not sure if there are added costs and complexities when doing storage as an add-on vs. installing both all at once.

Why in your analysis does a PV only system cost $21,000 and the PV+Battery system cost $11,000?

But glad to see your comments. I’ve modeled many systems, and found similar results to what you stated in your article.

pretty sure the battery system is a delta 11k

I appreciate the comments on here.

I’ve been getting direct feedback and responses via email also. For anyone that would like to see all the underlying assumptions we used in the analysis, I’m happy to jump on a quick screenshare and walk you through how we ran it in Energy Toolbase. Contact me and we’ll schedule a time (adam@energytoolbase.com). If you’re not currently an ETB customer, we’d be happy to hook you up with a free trial so you can test drive our storage modeling capabilities for yourself.

@Victor, you’re right, SCE website is now saying TOU-D-PRIME is open to all customers on 4/30/19, i was not aware of that when i published this (https://www.sce.com/residential/rates/Time-Of-Use-Residential-Rate-Plans).

I think it was a big win for the IOU’s they put solar way back of being worth the effort and with the tax credits fading down it will not be in the future for many residential customers. Instead it will be utility scale projects owned by big corporate interest selling energy for what ever the time permits.

Its pretty much like usual in the good ole USA the wealthy getting wealthier and maintaining controll over the basic human needs…

Think it would be better for all if the put community large scale storage in the future and made it worth while for homeowners to use PV to supply it. probably not likely in IOU territory…

Does you study take into consideration the degradation of the battery production over time? LG claims 60% power after 10 years in warranty information. Also does the study specify a type of panel? Standard silicon technology has different performance characteristic and performance warranties from manufacturer(s.) What about back contact technology ( Neon R and Sunpower?)

I have done many variances to system size? V.s. batteries. what size solar system is the $ when building a system under 10 KW? When do batteries make sense? How important is “load Shifting”?

This is SCE TOU 4-9.

What do you recommend?

The sce website says that rate will be available starting April 30 fyi. Nice overall analysis though.

Nice article Adam, but doesn’t solar+storage in Hawaii also pencil? I suppose that isnt energy arbitrage like California, but economics of adding storage are still better.

In response to the question about “does this pencil in Hawaii”, the answer is yes. As a rule of thumb, anywhere the difference between on-peak rates and off-peak rates is 3X or better, that is the cost during peak hours is three times higher than off-peak hours, TOU arbitrage will work.

But, in both cases, the one presented here and Hawaii, the results are highly dependent on your actual load profile and size of your daily load. If you’re a heavy on-peak user, you’ll more heavily tax the batteries and thereby shorten their useful life. If your daily consumption is large, you’ll need more batteries and the result could be a lower ROI.

I presented a study of power arbitrage analysis for both Tesla Powerwall II with Enphase microinverters and LG Chem with SE Inverter as a poster session at the 2017 SPI Conference which covered a similar analysis using actual loads and Hawaii Electric Light Co (HELCO) TOU rates vs their flat rate option. You should be able to find my results in their archives.