By Todd Pistorese, CEO, Intelligent Design Solar

This is a complementary article to the previously published Case study: When solar+storage operating in time-of-use arbitrage mode beats the economics of standalone solar by Adam Gerza, COO of Energy Toolbase

This article discusses the potential benefits for homeowners wanting to install grid-interactive solar-plus-storage operating under Southern California Edison’s new time-of-use (TOU) rates. We analyze whether choosing to store and shift energy (using a Tesla Powerwall 2 Li-ion battery) under a TOU rate plan provides any economic benefit. While the Tesla battery is a stand-alone storage solution, we’re evaluating it here as an addition to a new solar system.

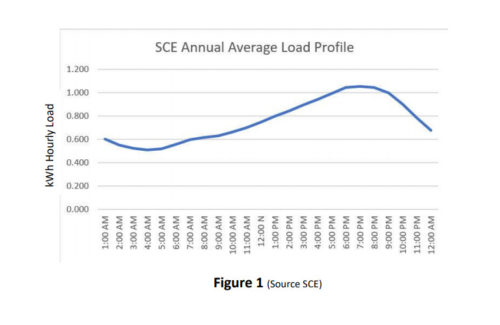

Power arbitrage is accomplished by charging a battery at the lowest TOU rate, or from solar, and discharging the battery at a higher on-peak TOU rate period for an effective reduction in peak-hour energy costs. If the customer has a typical Southern California Edison (SCE) residential load profile, as shown below in Figure 1, there is a potential benefit from energy storage, provided the utility TOU rates have a high enough differential between off-peak and on-peak prices ($/kWh).

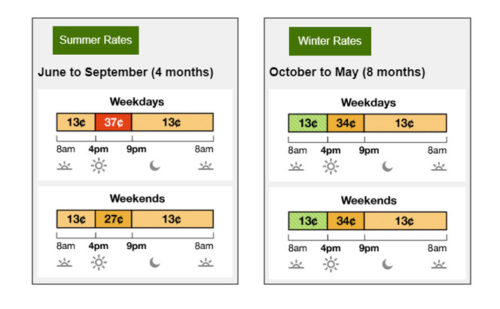

To determine what size energy storage system a customer can most benefit from, we first look at the TOU rates offered by the utility. In our example, the residence receives service from SCE that offers residential 2-tier TOU rates, as shown in Figure 2.

Our goal is to charge our customer’s Tesla Powerwall mid-day between 8 a.m. and 4 p.m. while rates are 13-cents/kWh and solar production is at its highest. Each Tesla battery has a capacity of 13.2 kWh, so, barring available solar generation, it will cost $1.72/day to fully recharge at off-peak TOU rates. Battery charging by solar will cost $1.06/day. Once charged, we’ll set the Tesla Powerwall clock to disconnect the customer from the utility at 4 p.m. and remain disconnected until 9 p.m. during which time we’ll operate our loads using battery-supplied power, assuming the batteries can handle peak demand. We calculate our customer’s installed solar prior to batteries has a 25-year net present value (NPV) cost of $0.08/kWh of installed capacity. The solar system size can, on average, charge the battery and cover daytime loads for our customer.

Questions we want to answer:

- How much energy is used between 4 p.m. and 9 p.m. measured in kWh?

- How many Tesla batteries are required to cover our on-peak loads?

- What is the monthly energy cost savings from power arbitrage using energy storage?

- What is the anticipated Tesla battery warranty life based on this use?

- How long until return on investment (ROI) reaches breakeven?

- What is our energy storage lifetime cost/benefit?

Let’s assume our customer has the average load profile we found on the SCE website. We derive the following detailed average hourly kWh usage from SCE collected data:

- Daytime usage: 8 a.m. – 4 p.m. = 10.726 kWh

- Evening usage: 4 p.m. – 9 p.m. = 10.914 kWh

- Nighttime usage: 9 p.m. – 8 a.m. = 10.726 kWh

- 24-hour total usage: 32.878 kWh

At SCE summer/winter tiered rates, our customer’s daily power bill comes to $7.03 or an average monthly bill of $213.78.

TOU cost without energy storage

On TOU rates without energy storage, we see a daily cost of $6.89, or an average monthly bill of $209.52. Our customer has an insignificant ($4.26/month) financial benefit from moving to a TOU rate structure, without investing in energy storage or changing usage patterns. Remember, this benefit, if it exists, varies significantly depending on each unique customer’s load profile.

TOU cost with Tesla Powerwall battery and power arbitrage

SCE’s data indicates that our example residence will use 10.914 kWh during peak TOU hours between 4 p.m. and 9 p.m. daily. One Tesla Powerwall, at 13.2 kWh capacity, will cover evening use by discharging 82.7% of its stored energy. To determine the cost of energy from the battery in $/kWh we need to analyze energy throughput.

What is the battery throughput and $/kWh rate?

Tesla states that its warranty under arbitrage-use conditions is based on 37 MWh of battery throughput. Throughput is defined as the energy moved through the battery during each roundtrip discharge/charge cycle. To calculate the length of the warranty period we multiply our daily discharge by 365 to determine annual kWh discharge then divide half of 37,000 kWh by that number. For this example customer, the equations are:

- 10.914 kWh/day x 365 = 3,983.61 kWh/year (annual kWh discharge)

- 37,000 kWh / 2 / 3,983.6 kWh/year = 4.64 years warranty life (ignoring losses)

The cost per kWh from the batteries is calculated by dividing the battery installed cost (we’re using a common federally subsidized installation cost) by the lifetime discharge, which we determine by multiplying the annual kWh discharge by the estimated 4.64-year life of the battery. The equation is:

- $6,020 installed cost / (4.64 x 3,983.61 kWh/year) = $0.326/kWh (cost per kWh from the batteries)

Daily discharge rate multiplied by cost per kWh gives us our daily power cost from batteries. The equation is:

- 10.914 kWh x $0.326/kWh = $3.56/day

Recharge is at the solar avoided cost of $0.08/kWh.

- $0.08/kWh x 10.914 kWh = $0.87/day to recharge

Since this recharge power is energy we would otherwise export, we need to include it in the cost of battery energy. The daily weighted average rate becomes $0.178/kWh.

- 32.878 x $0.178 = $5.85/day

From this we get an average monthly bill of $177.90. This delivers a benefit of $35.88/month, which amounts to a 16.8% decrease in energy cost over the tiered rate cost and a 15.1% decrease from TOU rates with no arbitrage. (Mid-day and nighttime covered by TOU rate; evening hours covered by battery rate.)

In 12 months, our customer with solar-plus-storage will have saved $430.56. The simple ROI occurs in 14 years.

Our Tesla Powerwall lifetime ROI is calculated as 4.64 years at $35.88/month which nets a $1,997.80 energy savings minus the original $6,020 Tesla battery purchase, or a negative 4.6-year ROI of $4,042.20. If our customer purchased 4.64 years of energy at daily tiered cost of $7.03, it would have cost $11,906. The Tesla solution at $5.85/day, costs $9,907.56 + $6,020 = $15,927.56.

Returning to our initial questions:

- How much energy is used between 4 p.m. and 9 p.m. measured in kWh?

- Answer: 10.914 kWh

- How many Tesla batteries are required to cover our on-peak loads?

- Answer: 1 (82.7% discharge daily)

- What is the monthly energy cost savings from power arbitrage using energy storage?

- Answer: $35.88/month

- What is the anticipated Tesla battery warranty life based on this use?

- Answer: 4.64 years

- How long until return on investment (ROI) reaches breakeven?

- Answer: 14 years

- What is our energy storage lifetime cost/benefit?

- Answer: -$4,042.20

Solar without storage

A 7-kW solar system without storage has a levelized 25-year installed cost of approximately $0.08/kWh. Assuming $0.08/kWh payment for exported energy, this solution would average on a monthly basis:

- Produce 904 kWh

- Self-supply during daylight of 342 kWh at 8-cents/kWh

- Export 562 kWh at 8-cents/kWh

- Directly offset 33.2% of customer daily energy needs

- Offset 60% of customer energy costs or $1,539/year

- Attain a positive ROI in less than 8 years

- Provide this benefit for 25 years

This analysis based on the SCE average residential load profile shows that power arbitrage using energy storage is not economical without financial subsidies beyond the federal ITC anticipated here. Results will vary significantly based on the personal load profile and the daily load size. Detailed load analysis will make decisions regarding energy storage and solar system sizing a straightforward economic analysis, rather than a guessing game. Power arbitrage benefits utility operations. Additional ongoing analysis can help ensure benefits are being achieved and provide useful information on appliance health. Knowing how you use electricity will help you identify additional ways to save money on your electric rates.

In this instance, the customer gets the best economic results by simply switching to TOU rates. Adding solar reduces daytime electric rates by approximately 41%. Any export above daytime load requirement will be paid at a slightly reduced rate to the stated TOU daytime rate but is a positive benefit in reducing the customer’s electric bill. The customer can further improve their economics by changing their load profile (energy use patterns).

About Intelligent Design Solar

The analysis provided here is just one example of how IDS technology is being used. IDS provides an IoT/cloud-based, distributed energy resource and load management solution designed to support multiple purposes and end users. Visit intelligentdesignsolar.com for more information.

What I find interesting about this deep dive article written in 2019 just three years ago needs research on not only SCE rates in 2022 but battery chemistries used in Residential units like those provided by GENERAC, Briggs & Stratton, Sonnen that use (LFP) chemistry that can daily cycle 20% SoC to 80% SoC for somewhere right at 4,000 cycles, allows one 11 years in use and probably beyond to a battery pack that can still supply 60% capacity after 15 years of daily use. An Engineer from the Estonian company Skeleton Ultra capacitors claims adding something like 1% to 10% Ultra capacitors to the output of a (LFP) battery pack allows a high energy parallel discharge resource to downstream electronics like inverters used to suppliment or power a home from 48VDC to 240VAC. A friend in SCE territory has had a ‘new’ tier rate program in place that has $0.19/kWh in off peak and from $0.45/kWh to $0.47/kWh during the TOU period from 4 PM to 9 PM each day. Then in rote IOU electric utility PG&E territory, there are ‘similar’ rate programs in place and also the onerous PSPS which can shutdown your grid electricity for hours to days during specific storm events. What’s the ROI on replacing everything in the refrigerator and freezer due to a PSPS event and how many times will you suffer this until you start looking for resiliency and critical circuit backup for your home? ROI is oversold, the electric utilities ROI argument.

I reviewed a few SCE solar bills and it looks like NEMA 2.0 pays 1:1. The grid is the powerwall.

Would love to see an article on which SCE Net Energy Metering program to pick with powerwall + solar installations.

Here’s something that might help: https://www.solarpowerworldonline.com/2020/04/energy-storage-net-metering-an-illustration-of-why-its-so-valuable/

We’re taking a conservative approach to the analysis here, but I guess it depends on how you interpret it: Are Solar Self-consumption and Time-based Control a combination of applications? I would say there really isn’t any difference between the two except for the source of energy charging the battery. If these are different from Tesla’s viewpoint it appears they represent a combination of applications. Tesla could then argue the 37 MWh throughput condition applies.

In any case, without a change in the customer load profile their simple ROI is greater than either Warranty Period. This is not to say that the battery will no longer function out of warranty. It’s only a measurement used in evaluating the investment for Arbitrage use. The customer will have to decide whether they can expect useful life beyond the battery warranty and I would strongly suggest they get clarification from Tesla on their interpretation of the Warranty conditions.

The assumptions made on the Tesla Powerwall Warranty battery life are not accurate. The Powerwall Limited Warranty (https://www.tesla.com/sites/default/files/pdfs/powerwall/powerwall_2_ac_warranty_us.pdf) explicitly states that when operated solely in time based control mode the Powerwall can perform unlimited cycles and will have 70% energy retention at year 10.