Before the passage of the Inflation Reduction Act (IRA) over a year ago, tax credits for solar projects were available only to taxable entities. That meant that while tax-exempt and government entities — such as nonprofits, churches, schools and tribes — could go solar via a lease or PPA, they couldn’t directly take advantage of the Investment Tax Credit (ITC).

Thankfully, the IRA changed this limitation with its direct pay provision, also known as “elective pay.” Direct pay allows nonprofits to receive a payment that’s equal to the full value of tax credits when they build qualifying clean energy projects.

Direct pay is undoubtedly a boon for nonprofit entities and should spur much more solar development in this sector. But a couple lesser-known provisions in the regulations could cause snags for nonprofits that aren’t aware of them, as well as for solar developers working with nonprofits.

1. Avoiding the “excessive benefit” pitfall

The “excessive benefit” provision is not part of the IRA bill text itself, but it’s in the regulations from the Dept. of the Treasury, which was authorized in the IRA to provide interpretive guidance and implementation rules. The provision is intended to ensure that tax-exempt entities do not receive funding in excess of their project’s cost by combining direct pay with a grant or donation.

Under this provision, if your nonprofit funds all or a portion of your solar project with grants or charitable donations that are specifically earmarked for solar purposes, your direct pay benefits could potentially be reduced or even completely eliminated. Your ability to claim direct pay will be reduced to the extent that the grants earmarked for solar plus the direct pay amounts exceed the purchase price of the solar system. General grants and donations not earmarked for solar projects will not affect direct pay for a project.

For funds to be considered earmarked for a solar project, the grant or donation would need to go toward “purchasing, constructing, reconstructing, erecting or otherwise acquiring” the solar project.

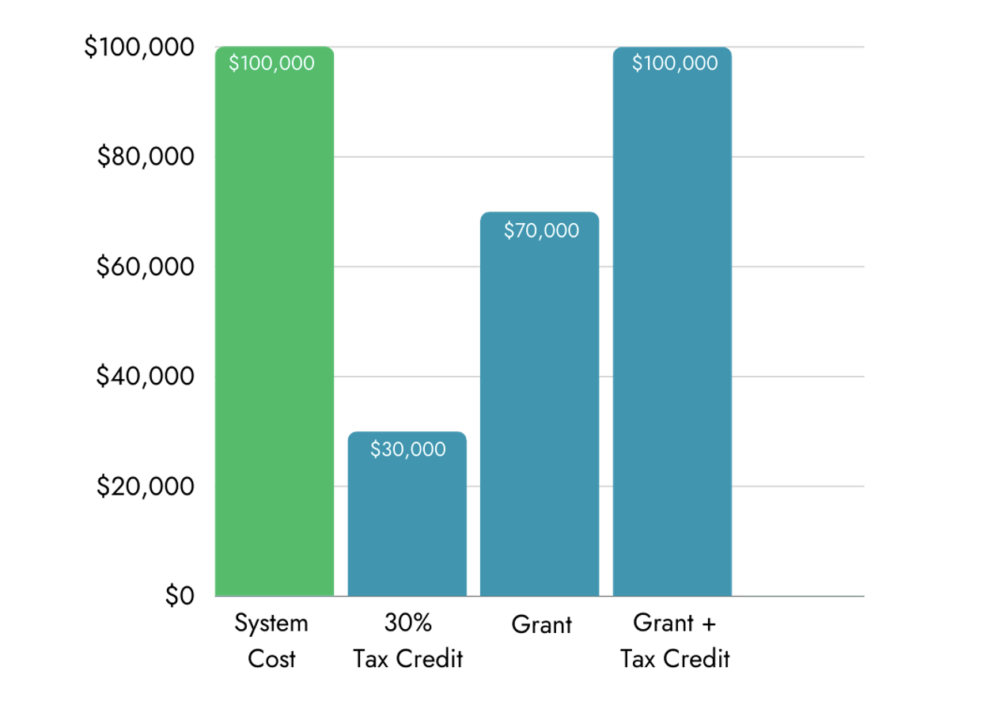

To see how this works, let’s use the example of a project that costs $100,000 and is claiming the base 30% tax credit. If the project is also getting a grant of $70,000, it can get the full 30% credit because the tax credit plus the grant does not exceed the cost of the project.

On the other hand, if the nonprofit receives a grant of $80,000 earmarked for the $100,000 project, it can receive only part of the 30% tax credit — in this case, $20,000, because any more would exceed the cost of the project.

Knowing about this provision can help your nonprofit tailor your fundraising to allow for full receipt of any tax credits your project is eligible for.

Knowing about this provision can help your nonprofit tailor your fundraising to allow for full receipt of any tax credits your project is eligible for.

How will the IRS know where your project’s funding came from? Nonprofits will be asked this question in the pre-filing registration portal that is required to be completed when utilizing direct pay.

2. Avoiding timing issues

Because many nonprofits have fiscal years ending on June 30, their tax year is not the same as the calendar year, so that will affect when they can apply for and receive direct pay. A nonprofit can claim direct pay for projects that were placed in service during their tax year, but only if their tax year started after December 31, 2022.

For example, if your nonprofit had a tax year that started on July 1, 2022 and ended on June 30, 2023, your solar project would not be eligible for direct pay if it was placed in service during that time period, because your tax year did not start after December 31, 2022. However, if your solar project was placed in service the following tax year — that is, between July 1, 2023 and June 30, 2024 — it would be eligible for direct pay, but not until the tax return for that period is due (i.e., fiscal year 2024).

To claim direct pay, even a tax-exempt organization that does not normally file tax forms must file a 990T form five months plus 15 days after the end of its tax year. For a nonprofit with a year-end of June 30, that filing deadline is November 15. To receive direct pay for your project, you are required to complete the pre-filing registration and complete the tax filings on time or with an extension. You only have one chance to complete this step. Treasury does not allow going back to a prior year to claim direct pay, nor does it allow carrying a project forward.

If you have the flexibility to place your solar project in service close to the end of your nonprofit’s tax year, that will decrease the funding gap.

Checking for the latest regulations

As of mid-November, Treasury has released guidance and proposed regulations on direct pay. Be sure to check back for the final regulations if you’re reading this at a later date and plan to file for direct pay.

For more on direct pay and the pitfalls to avoid, see CollectiveSun’s recent direct pay webinar and Excessive Benefit Fact Sheet.

Disclaimer: This information does not constitute legal or tax advice and should not be relied upon for any purpose. Please consult your legal counsel and tax advisor.

Tell Us What You Think!