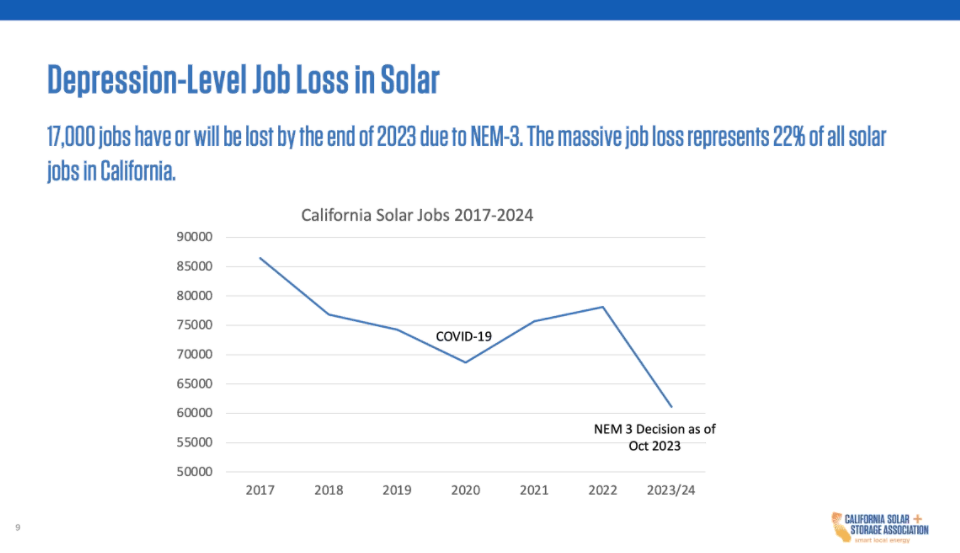

The California Solar & Storage Association (CALSSA) held a grim media briefing on November 30 featuring five residential solar company owners discussing the impacts of the state’s new NEM 3.0 net billing regime on their businesses. NEM 3.0 was approved by the California Public Utilities Commission (CPUC) in December 2022 and went into effect in April 2023. As a result of NEM 3.0 decreasing the amount of money homeowners can receive for feeding solar back to the grid, 22% of solar jobs have been lost, and 59% of the state’s residential solar + storage contractors expect layoffs, according to a survey of CALSSA’s 700+ members.

CALSSA’s graphic representing job losses reported in a member survey.

Solar sales in the state are down between 77% and 85% year over year, according to Ohm Analytics, which hosts a proprietary database of solar projects in the United States based on permit and interconnection data. Interconnection application data from two of the three large California utilities, PG&E and SCE, also showed volume down between 66% and 83% year over year.

The contractors on the call provided their own anecdotes to paint a bleak picture of the state that used to lead the nation in solar policy.

San Diego’s HES Solar has been in business for over 20 years and just downsized from 70 to 33 people. Fresno’s Energy Concepts has 32 years of business under its belt and just reduced its workforce from 70 to 35 people. And Arcadia’s Construct Sun has already pulled out of California altogether to focus its resources on states that still offer one-to-one net metering on the East Coast and Midwest.

“You don’t just hire somebody and then they start working for you, it takes years and years to develop skills. And we love to promote from within,” said Ross Williams, CEO of HES. “All those jobs are gone. Years and years of workforce development have just been wiped out, so it’s pretty depressing.”

Carlos Beccar, marketing director at Energy Concepts, said the hardest part of his job now is explaining NEM 3.0 to customers. The CPUC’s main argument for the plan was avoiding the duck curve of midday solar generation by encouraging more residential battery installations using complex hourly export rates. But even though some contractors on the call said they’re selling more batteries in California than before, the overall volume of work is way down.

“A lot of people talk about batteries and make it sound like it’s this simple thing — you just take a battery and plug it in. And it is so much more complicated,” Beccar said. “You have to have a system that’s big enough to charge the battery. Just because you have a battery, you can’t put a smaller [solar] system in by default. We’re selling the batteries; we love selling batteries; customers love the batteries. But the math is not there, even with a battery solution — it’s double the price; it’s not there.”

Most of the conversation focused on the residential market, but CALSSA executive director Bernadette Del Chiaro said commercial installations will feel the pain next, likely in 2024. The longer timelines for these projects have delayed the more immediate impacts felt by the residential market. But Kenneth Wells, CEO of O&M Solar, said his company is already seeing a preview of this in its commercial work.

“One of the things I focus on is doing subcontracting, and we’re not seeing as many bids for 2024 coming. We’re not seeing as many projects as we did the prior year,” Wells said.

CALSSA tried to end on a hopeful note, outlining three requests for policymakers to stave off additional harm to the industry. The group is asking for no further actions that could harm the market — including no solar taxes or fixed charges on residential customers and no limitations on licensed solar contractors installing solar + storage. It’s asking for a new “Million Solar Batteries Initiative” to make this technology affordable for homeowners, similar to the “Million Solar Homes Initiative” by the Schwarzenegger Administration. And it’s asking for the state to cut more red tape by getting firm with utilities about interconnection delays and simplifying permitting at the city and county levels.

Still, CALSSA said the harm already felt in the peak summer solar sales season is not a good sign for the traditionally slower winter ahead.

“It’s 2023. California has declared … that climate change is a crisis. We need three-times more solar energy and we need it as fast as we can,” said Del Chiaro. “We need more batteries. This should be the Golden Era. This should be the heyday. We should be hitting our stride and sprinting to the finish line. And instead we have California’s footsoldiers in the market to build our clean energy future in the most fast and accessible manner worried that they’re not even going to be able to make it through the winter.”

To add to this, there is no mention of the other policies in California, like AB2143 that will increase commercial solar costs while making the benefits of NEM sparse. Unfortunately, things need to get worse before they get better. But Solar will prevail! Homeowners will choose a more sustainable future.

Ron DeSantis would have loved to had this information about California losing jobs, last week when he debated Newsom. Great article!

Kelsey,

I love the articles provided by Solar Power World. They are so insightful in understanding the pulse of the solar market.

I am a developer with Cedar Creek Energy in Minneapolis, Minnesota, with 16 years of solar design and installation. With your incredible knowledge of the industry what two solar financing programs are you aware of that seem to be providing the best solutions for homeowners?

Good Leap and Sunlight