By Julia Bell, chief commercial officer, CleanCapital

For the last decade, “tariff” has been an all-too-familiar term in the solar industry, evoking a mix of strong opinions among stakeholders. In 2012, the Obama administration first imposed tariffs on certain imported cells and modules in an attempt to rescue the declining solar manufacturing industry. In 2018, the Trump administration expanded this approach with the imposition of Section 201 solar tariffs. The Biden administration followed its predecessors in extending the Trump-era tariffs earlier this year. After a decade of various tariffs on solar imports, the U.S. solar manufacturing industry is still struggling.

As we have seen over the past decade, tariffs alone – even paired with the investments in U.S. solar manufacturing promised by President Biden’s recent executive actions – won’t ensure a vibrant domestic manufacturing capability and will fail to create sufficient high-quality jobs for American solar industry workers. Only the combination of thoughtful long-term development plans combined with policies that prioritize the construction of near-term projects will bring about a holistic, world-leading, domestic U.S. solar industry capable of achieving Biden’s goal of a national grid run on 100% clean electricity by 2035.

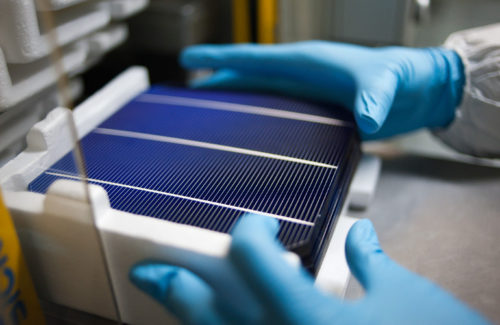

The U.S. demonstrated the first practical silicon solar cell and was once a strong technology leader in the field, but as China ramped up its substantial subsidies without an accompanying response here at home, it has become incredibly hard for U.S. companies and workers to compete. While some argue that taxing imports is the best way to promote domestic manufacturing, tariffs are not a silver-bullet solution, especially on a short timeline.

Despite a decade of tariffs, U.S. producers of PV modules, solar-grade polysilicon and silicon PV wafers and cells lost 80% of their global market share from 2011 to 2021. Domestic supply remains woefully inadequate to meet demand: an estimated 7.5 GW of domestic PV module production capacity vs. nearly 25 GW of expected installations this year alone, according to Wood Mackenzie. Implementing tariffs without dealing with the realities of that imbalance creates an adversarial relationship between U.S. workers and solar proponents. This pits two great causes against each other in a false dichotomy and distracts from our shared vision of American energy independence.

Over the last few years, the tariff caused many solar developers to turn from a reliance on Chinese panels to dependence on suppliers in other countries. But the Auxin trade complaint set the industry on its heels, sparking a chain reaction that threatened the very future of the industry. The possibility of new tariffs jeopardized 64% of 2022 U.S. solar additions; even the initial investigation halted the flow of more than half of U.S. supplies and 80% of imports.

Tariffs increase the cost of the products themselves and heighten the uncertainty created by scarcity and delays – which in turn, makes underwriting these projects riskier and more expensive. Tariffs also carry the risk of creating a lag in U.S. technology advancement, as new, more efficient module availability is limited in favor of import-substitution production. This jeopardizes long-term project performance and returns. Fluctuations in commodity pricing, increasing steel costs driven by the war in Ukraine and the inability to move components and materials off boats in U.S. ports only further contributed to a marked slowdown in clean energy deployment.

Across the industry, there is very little confidence that near-term projects can be completed on time. This leads investors like CleanCapital to carefully reconsider where we invest. Efficient deployment of capital relies on certainty that projects can get built on time, within budget and without policy risk. But now we live in a world in which a module order placed today won’t arrive for a year. In fact, many panel suppliers have delayed or outright canceled orders. If the industry is reduced to just trading operational projects, we can’t fulfill our mission to accelerate nationwide investments in solar and contribute to decarbonization efforts. Meanwhile, reliance on fossil fuels continues, increasing our carbon footprint and the associated negative environmental impacts.

In welcome news, President Biden recently used executive action to provide a two-year tariff suspension on solar cell and module imports from Cambodia, Malaysia, Thailand and Vietnam. While the U.S. Department of Commerce continues to pursue the Auxin case, this gives solar contractors some ability to continue work.

Realizing a future in which the United States meets its clean energy goals with projects comprised of domestic, homegrown panels and components requires federal action to ensure the industry will not be whipsawed by ineffective trade policy once again. Developers are working on projects several years out, and financial institutions need assurance now that their investment dollars will result in fruitful, flourishing projects later.

There is an opportunity for the government to provide this assurance by offsetting the punitive effects of the tariffs with substantial, long-term investment in the U.S. solar industry. Today, money paid in solar tariffs flows into federal government coffers with unknown destinations. Why not offset the burden tariffs placed on the solar industry with policies that ensure investments in its continued growth? Closing this loop will spur American innovation and reduce the need for imports as domestic production achieves commercial viability.

Policies that rely on American ingenuity to bind together domestic workers in both the upstream and downstream solar industry will allow the United States to once again stand on its own and be a leader in the field. While President Biden’s invocation of the Defense Production Act to expand U.S. manufacturing of solar panel components is a welcome step, funding from Congress remains uncertain. Only substantial subsidies will help U.S. manufacturers regain their footing and trigger the kind of technological innovation that once made the United States a vanguard in this field. And while the Build Back Better Act remains in legislative purgatory, Congress should take the critical step of extending and expanding proven policies like the investment and production tax credits along with direct pay to boost solar deployment.

Despite these headwinds, we must remember that solar is still ascendant. To build the renewable energy capacity necessary to foster a resilient clean energy economy, the federal government must enact thoughtful, realistic, long-term plans that bring about a robust domestic manufacturing sector without threatening near-term projects.

At the end of the day, clean energy is a public good. Mitigating the climate crisis, creating well-paying jobs, and promoting domestic energy independence is a win for our planet and our nation. And, it’s simply the right thing to do.

Julia Bell oversees project acquisitions, due diligence, and construction for CleanCapital, including structuring, negotiating, and implementing the company’s acquisition and development strategies. Prior to joining CleanCapital, Julia was an energy and project finance attorney with global law firm White & Case LLP in New York City and Mexico City. Before practicing law, Julia worked as a policy adviser for operations in the Mayor’s Office of the City of New York. Julia is a graduate of the University of Chicago and NYU School of Law.

Julia Bell oversees project acquisitions, due diligence, and construction for CleanCapital, including structuring, negotiating, and implementing the company’s acquisition and development strategies. Prior to joining CleanCapital, Julia was an energy and project finance attorney with global law firm White & Case LLP in New York City and Mexico City. Before practicing law, Julia worked as a policy adviser for operations in the Mayor’s Office of the City of New York. Julia is a graduate of the University of Chicago and NYU School of Law.

“Despite a decade of tariffs, U.S. producers of PV modules, solar-grade polysilicon and silicon PV wafers and cells lost 80% of their global market share from 2011 to 2021.”

The bottom line is energy costs to produce the materials and for the finished product. China pretty much owns at least 4 of the largest silicon foundries in the World. China (owns) the supply chain on the very basic supply chain of silicon foundries, wafers and silicon cells. Tariffs and sanctions are worthless unless a robust supply chain is developed in the U.S. It has been said the U.S. needs about 50GW of solar PV cell production each year for at least a couple of decades, probably more. What’s happening right now in the U.S. you have some foreign corporation with their solar PV panel assembly plant, but are still depending on the Chinese silicon supply chain. You place 201 tariffs on Chinese silicon solar PV cells and shoot yourself in the foot at your own home manufacturing plant. This is like Barnam and Bailey clown car manic, that one finally figures out, isn’t so intertaining after all.