By Adam Gerza, COO of Energy Toolbase

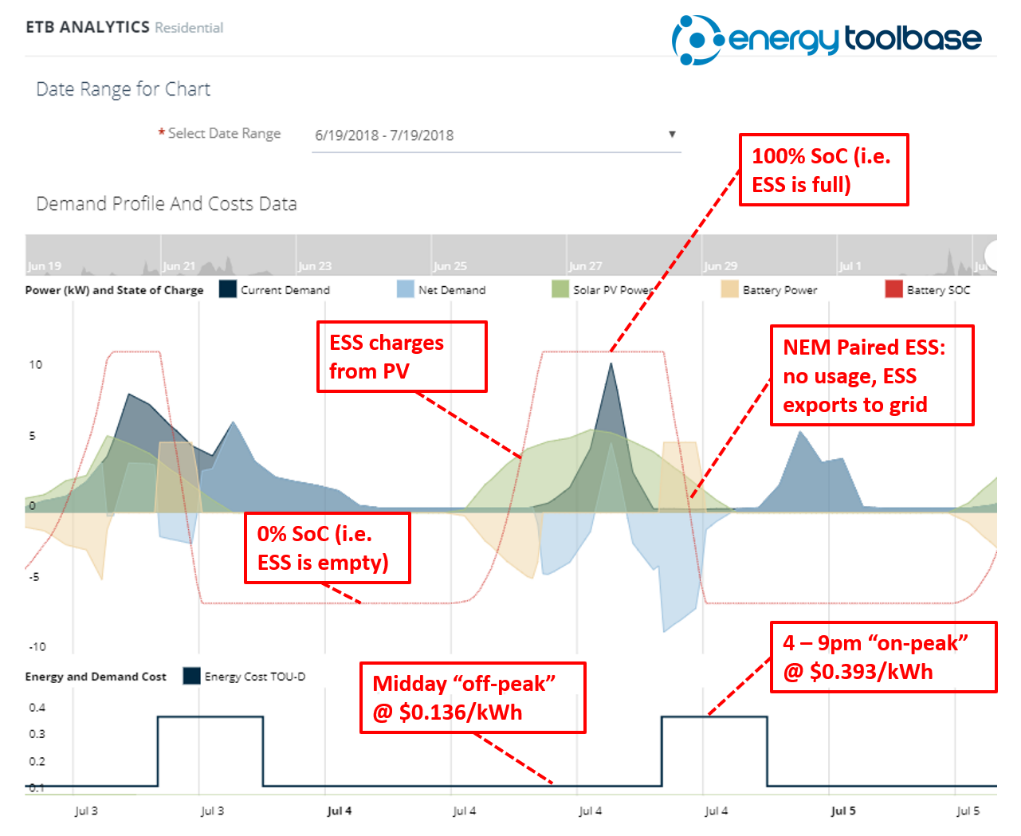

Energy storage net energy metering (aka NEM paired storage) allows a customer with a behind-the-meter solar + storage system to discharge their battery, exporting stored energy back to the grid and receive a net energy metering credit, if the battery can verifiably charge 100% from solar. In certain cases, NEM paired storage can meaningfully increase the amount of savings an energy storage system (ESS) can capture. As illustrated in the graphic below, energy storage net metering effectively enables a battery to utilize its full capacity by discharging fully when a strong price signal exists, regardless of customer usage.

Policy background

NEM paired storage was codified into law in California in February of 2019 when the California Public Utilities Commission (CPUC) finalized a decision permitting customers with ESS to receive credits for storage energy sent back to the grid if the storage system verifiably charged entirely from solar. The policy change was initiated by the California Solar and Storage Association (CALSSA) who filed a petition for modification (PFM) to grant the permissibility of NEM paired storage. CALSSA’s PFM drew support from California’s big three investor-owned utilities who filed a statement of support, which helped pave the way to the CPUC decision. Energy Toolbase published a blog “CPUC Approves Energy Storage Net Metering” summarizing the eligibility requirements laid out in that CPUC ruling.

Several months later the IOUs began allowing NEM paired storage systems to be interconnected to their grid. Energy Toolbase published another blog in December of 2019 entitled “California Utilities now Accepting Applications for Net Energy Metering (NEM) – Paired Storage,” which summarized many of the new metering and verification requirements, including the newly created Certification Requirements Decision (CRD) standard, which allowed utilities to verify the ESS charges entirely from PV. Previously, for ESS systems larger than 10 kW, customers were required to install additional metering hardware, which could be time-consuming and prohibitively expensive.

Case Study: NEM Paired Storage

To illustrate the value of energy storage net metering, we compared two identical solar + storage systems operating in time-of-use (TOU) arbitrage mode. We held all project inputs and assumptions constant, except in Case No. 1 we ran the ESS dispatch simulation assuming ESS cannot export to grid, and in Case No. 2 we ran the simulation assuming NEM paired storage: ESS can export to grid, but it must charge entirely from PV.

Assumptions used in the case study:

- Utility | Rate: Southern California Edison (SCE) | TOU-D-PRIME rate

- Annual usage: 13,243 kWh

- Interval data file: my house, located in Alhambra, California

- PV system size: 8 kWDC

- PV production profile generation: PV Watts v5 API (10 tilt, 180 south azimuth)

- ESS size: 5 kW | 10 kWh

- ESS dispatch profile generation: Energy Toolbase, TOU Arbitrage dispatch simulation

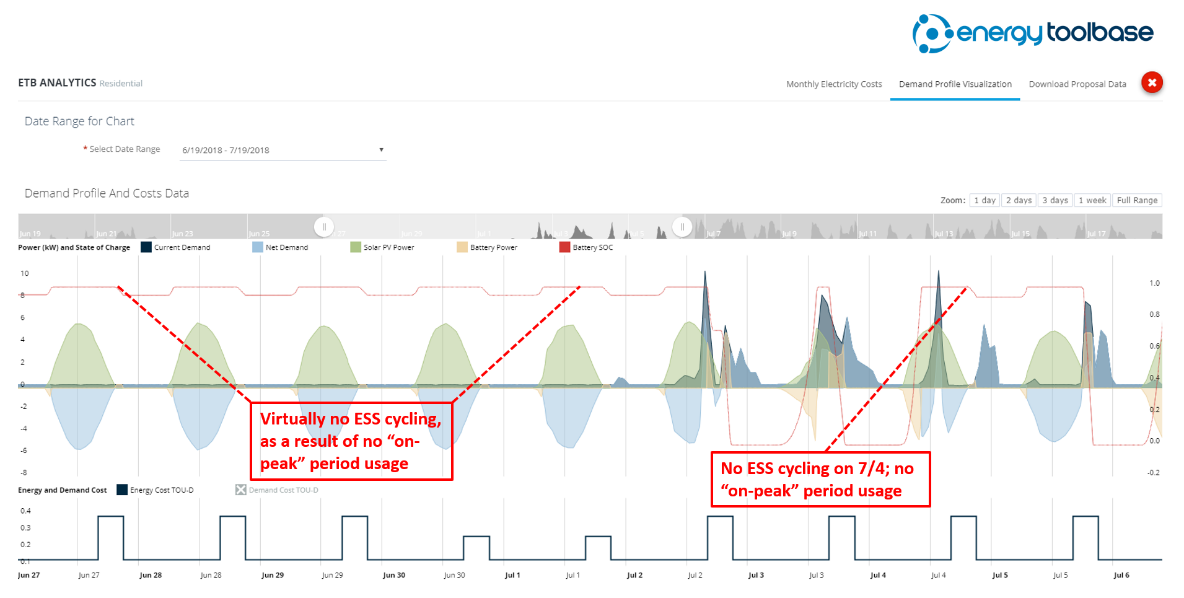

Case No. 1: ESS cannot export to grid

Explanation: The chart above displays: energy usage, PV production, ESS dispatch, net usage, and ESS state of charge (SoC) over a 10-day period: June 27-July 6. During the first five days, I was away on vacation and had virtually no consumption. As a result, the ESS barely cycled, only discharging ~5% of its rated capacity each day because it was restricted to only discharging to offset load.

The SCE residential TOU-D-PRIME rate schedule is an advantageous rate for ESS economics because it has a wide TOU price differential year-round. The on-peak vs. off-peak differential is $0.26/kWh in the summer and $0.23/kWh in the winter. But given that I was gone and had no consumption during the first five days, the ESS was handcuffed and effectively missed out on the lucrative opportunity to discharge during the 4-9 p.m., on-peak period. Also note on July 4, after I returned home, I was gone during the 4-9 p.m. period and had virtually no usage, which again prevented the ESS from dispatching and utilizing its full capacity.

Annual ESS result: Using the Energy Toolbase storage simulation engine, we ran a 365-day dispatch with the restriction that ESS could not export to grid. The ESS captured $504 in utility bill savings, cycling 236 equivalent cycles for the year.

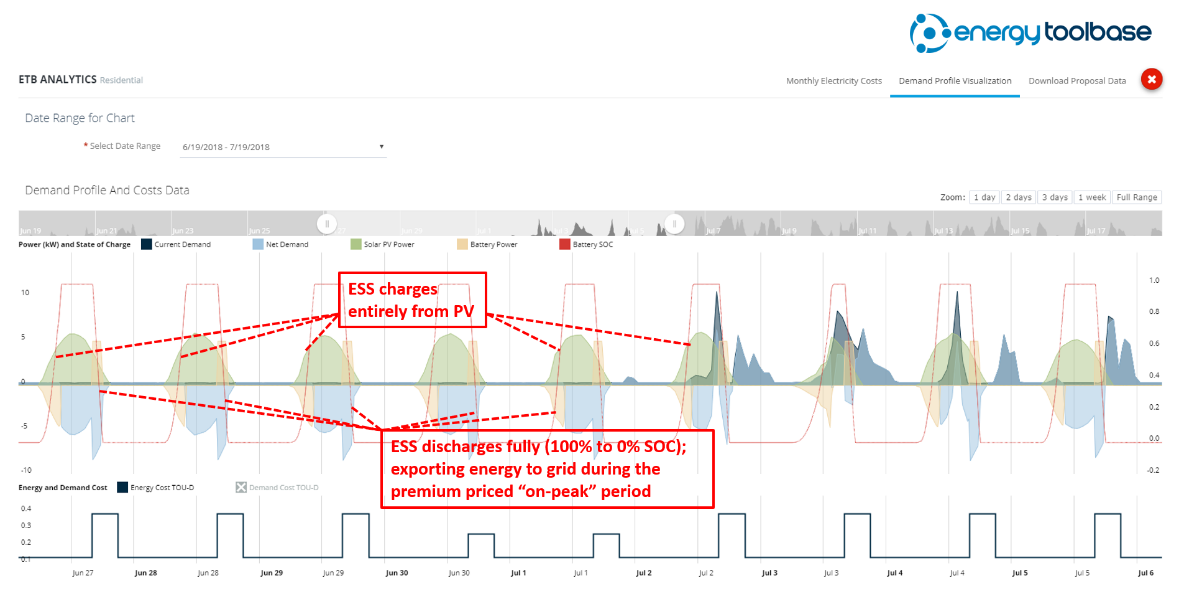

Case No. 2: NEM Paired Storage (ESS can export to grid)

Explanation: Zooming in on the same period; during the five initial days I was gone the ESS fully cycled, charging entirely from solar during the mid-day off-peak period, and then discharged completely, from 100% SoC to 0%, during the on-peak period. NEM paired storage enabled me to fully capture the lucrative $0.26/kWh TOU arbitrage differential while I was gone on vacation and had no consumption.

Annual result: We ran an ESS dispatch simulation requiring that ESS charges entirely from PV and permitting ESS to export to grid. The ESS captured $715 in utility bill savings, cycling 360 equivalent cycles for the year. By being able to fully utilize the battery’s capacity, regardless of my on-peak period consumption, resulted in 30% more utility bill savings compared to the no-ESS-exports run.

Note: This was not a cherry-picked example. This comparison was based on the actual 365-day usage of my home. There are certainly cases where the increased savings percentage that a homeowner could achieve as a result of NEM paired storage would be much higher.

Why NEM paired storage is so valuable

As illustrated above, energy storage net metering enabled the battery to utilize its full capacity by discharging when the price signal is strong, without any restrictions. For this same reason, NEM paired storage can provide meaningful benefit to commercial and industrial (C&I) customers also. Especially customers that have load profiles which use most of their energy during the day and then drop-off significantly at night, like an office building. For C&I solar + storage customers in California, it’s generally most economically favorable to rate-switch to a “solar-friendly” rate option, such as SDG&E’s DG-R rate, PG&E’s B-19 (Option R), or SCE’s GS-2-TOU (Option E) rate. These “solar-friendly” rates effectively reduce $/kW demand charges in exchange for higher $/kWh energy charges. Therefore, capturing the TOU arbitrage value stream becomes a much more meaningful part of the ESS savings opportunity. To maximize utility bill savings, the storage energy management system (EMS), which controls the battery dispatch would target both demand charge management and TOU arbitrage value streams. In Energy Toolbase, we allow users to run value stacking ESS dispatch simulations, either restricting ESS exports to the grid or allowing them.

Lastly, it’s important to point out that NEM paired storage also provides significant benefit to utilities and independent system operators (ISOs). Enabling storage systems to dispatch their full capacity can help alleviate low supply, high demand grid imbalance issues. In California, the “duck curve” is a result of a sharp ramp up in the system peak in the early evening due to residential load coming online, coupled with falling supply from solar PV production going to zero. This is a perfect opportunity for NEM paired storage to play a role and is not much different from utility grid services programs that allow distributed energy resources to participate in wholesale markets and capture revenue through demand response. Energy storage net metering is a win-win situation: it enables a battery to utilize its full capacity and maximize value capture, and it helps utilities balance the grid. Hopefully, other states will codify this mechanism into law and create strong price signals so all parties can benefit.

Connect with Adam Gerza and Energy Toolbase on this topic on the company’s blog.

This is the second time a receive NEM Paired Storage Account billing NEM Tune up adjustment averaging $2800 00 per year now? After reading the remarks by others and reading fine print stating charges can not be off set by credits, who can install the hardware storage edge converter? Aside from adding more panels and a second Tesla Storage for on site use deferring the storage of electrical use or will the Commision come up with another way to build consumers?

Any ideas?

It comes down to dollars, doesn’t it? Not bs given to you by a s.panel guy (the new siding salesmen) but a pay back of your investment in 10 years. 1. got land cheap but power is 50k for a 1mile run, then 22k for turn key with ion batteries saves you 28k. E. utilities are there for profit and will shut you down if they are going to cook their mains, (brown outs). For the kind of take it or leave you have in California utilities I’d pay the 22k and make the ceo sell his Ferrari.

Great article Adam. Presents a strong case for NEM storage value. RH

I have a solar system that completely covers my home needs. I am on sce nem 1.0 with no tou. If I add two Powerwalls and switch to tou I would be making money (or at least credits). Is that credit refundable at the end of my year??

This is why “self consumption” is a more important concept than NEM. There is at least one solar PV inverter out there that can be set up for grid interactive. A case where the inverter is grid tied with battery backup and can be programmed to “sell” a programmed amount of energy back to the grid. So, set the inverter to sell 500Wh of A.C. back to the grid and use the rest for the home’s needs. Then one can relegate the grid to back up power and not primary power. Not sure about the “controllability” of the inverter’s output when set up for grid interactive. It may be a 6.8kW inverter may be able to “roll back” so far on output and remain grid tied and ‘interactive’, allowing no less than say 3kW to 6.8kW of output. This kind of “hybrid” control would allow larger energy storage systems and larger solar PV arrays to handle the home’s electricity needs for (most) of the time. Something like a 12 to 15KWp array feeding a 48 to 60kWh ESS. If one is grid “interactive” they might also have the ability to power shed during grid fault or PSPS events and keep the home’s critical circuits powered for days at a time or continuously off solar PV and ESS. I see the future moving towards the day when a solar PV system will consist of the array, a smart ESS that has smart energy use algorithms that control when and how the ESS inverts power out to the grid, the home, and when the ESS charges and how much it charges due to the home’s power needs. In the final analysis, the ESS could also be used for arbitrage to store off peak grid power for the next days energy needs.

This “mandate” the system charge with solar PV to qualify for NEM is disingenuous, if one has this as a parameter, then set up and use the system as self consumption with some back up off grid power to the home during “grid events” and use the utility as a back up power source.

Do you know what inverter vendors have gotten the UL CRD certification to be able to operate in this mode?

I’m pretty sure, the Siemens Conext XW6848 pro and the older XW6048 are UL 1741 compliant. The Outback Radian series 8048 claims grid interactive operation. This is also the inverter/charger of choice for the Sonnen ecolux ESS series. So, the Radian inverter/charger is installed in the cabinet with the backup batteries BMS and an HMI interface to monitor and program the ESS operations. The SolarEdge (system) seems to require what is called an additional StoreEdge inverter to create the grid interactive function. It seems like the California Rule 21 has also created the UL 1741SA.