By Jim Spano, co-founder and head of originations at RadiantREIT; managing partner of Spano Partners Holdings

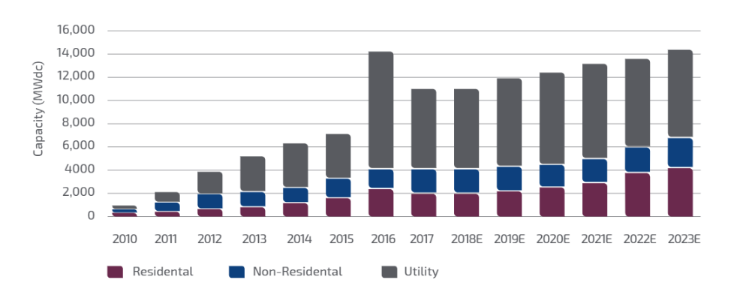

The solar industry is booming, with installed capacity growing by about 50% annually between 2015 and 2018. Yet inefficient and costly project financing inhibits many solar developers from tapping into the market’s true potential. With changes to the investment tax credit (ITC) looming, there is an opportunity to address some of the long-term financing challenges that have confronted the industry for many years. New debt financing vehicles, with terms that match the full operational life of solar projects, will support continued industry growth and will give developers of all sizes the opportunity to build a thriving business.

Solar financing today

The solar finance landscape remains a borrower’s market, but most of the loans that are available to developers today have shorter terms that are not in line with the operational life of projects. According to Wood Mackenzie Power and Renewables’ “U.S. Solar Project Finance and M&A Landscape,” mini-perm debt structures are the most common financing vehicle today. The number of total lenders and new market entrants is rising, which is increasing competition and has generally outweighed the negative effects of the ITC step down (a bit more on that later).

Mini-perm debt structures mean the lender offers repayment terms of four to seven years, after which the project sponsor must refinance. This structure is akin to financing your mortgage with a car loan, and results in negative project cash flows from day one. The result is a paradigm in which developers must flip their projects to investors in order to have working capital to develop their next projects. In effect, this means that project developers are only as successful as their last project. New models of long-term financing like the solar mortgage REIT can help break this cycle and align debt repayment terms to the operational life of the project, ensuring positive cash flow from commercial operation date (COD).

This is not a niche problem to address — 90% of solar projects in the U.S. are financed, meaning we cannot overlook the impact that financing has on whether projects succeed and market growth continues. If we can align financing terms with the operational life of solar projects, smaller developers will be able to grow their businesses more sustainably, with the option to either sell projects to aggregators or hold the cash flow of their most lucrative projects on their own balance sheets. It is a fundamental shift in how we think about the business of project development.

What is a solar mortgage REIT, and how will it help?

Real estate investment trusts (REITs) are widely deployed and proven in the real estate industry, and with similar attributes for the solar market, solar mortgage REITs can lower the cost of capital for projects, increase the net operating income of an asset and ensure positive cash flows over the lifetime of the PPA. Solar mortgage REITs offer fixed-rate and long-term mortgage loans to solar developers for new installations or long-term refinancing for existing projects. Ultimately, solar mortgage REITs can provide developers with the option to maintain ownership of a project.

On paper, it may be true that the ITC step-down hasn’t negatively impacted installed capacity growth, but the changes that come with shifting tax structures are important to recognize. One silver lining to the step down is that tax equity will become a smaller part of the capital stack for solar projects, making more room for debt to fill in that gap – as long as that debt is cost effective and long-term. Again, this ultimately enables developers to maintain ownership of more of their assets.

Project developers are the cornerstone of a successful solar industry, bridging the gap between technology and deployment. But even with the market success of solar as a reliable investment, developers continue to be hindered by suboptimal financing solutions. As we enter the ITC sunset, bringing proven investment vehicles for long-term financing will help to ensure solar’s growth is sustainable through changing incentives and for many years to come.

Yeah, Solar Mortgage REIT or solar mortgage derivative. With the de-facto and desperate electric utility industry fighting to stay relevant in an energy generation and distribution culture that is changing from centralized generation to distributed generation and away from grids to micro-grids with energy storage, there are a LOT of ways the electric utility industry can screw up a Solar REIT.

For the individual residential or business owner, take that money out of the bank at the annoyingly sparse 0.5% to 2.5% APR and put it on your roof as solar PV, add some energy storage and YOU have a hedge against the next move the desperate electric utilities will make to save themselves from extinction. These electric utilities are lobbying and suing to get the PPAs changed from net metering to net billing. They are also instituting Time OF Use or TOU electric rate increases from the 3PM to 9PM time of the day. IF you have solar PV with net billing, now you get a credit of from 4 to 6 cents per extra kWh pushed back onto the grid and then when your solar PV system begins to curtail generation for the day, you get to pay sometimes three or four times the regular retail electricity rate for those six hours every day. This kills your ‘accumulated electricity credits’ every day. So now, it is possible to put in a little less solar PV on one’s roof and use the energy storage system ESS to control when the battery is charged by over generation during the day and use that in the TOU portion of the night. Then use the energy storage system charging at the off peak or super off peak time of day, to use the inverted power the next morning before solar PV makes usable power once again.