By Frank Andorka, Editorial Director

In May, The New York Times wrote an article headlined “Solar Industry Anxious Over Defective Panels,” and alarm bells sounded throughout the industry. From panels to racking-and-mounting systems to inverters (and everything in between), the industry felt under attack.

But the conversations the article sparked frequently avoided the central question: Did The New York Times get it right?

When asked directly, most industry experts replied that long-term dependability is not a problem for the industry — yet. But all agree it’s an issue the industry should deal with before it becomes a problem. Otherwise, it threatens to tarnish the industry’s reputation and make it more difficult for the industry to capture the public’s imagination.

“Manufacturers are obviously concerned about it,” says Sunny Rai, regional vice president for renewable energy for Intertek, a global testing and certification company. “Assets that were installed five to eight years ago are starting to be sold to new owners, and they are concerned about whether these projects are producing what they promised. In some cases, they’re not — and that’s a potentially devastating problem for the long-term health of the industry.”

Identifying The Problem

There are two types of reliability issues, according to the experts. One involves catastrophic failure. The other involves the premature degrading of systems.

“While there have been instances of catastrophic failure, it’s perhaps more common for module performance to degrade faster than expected, which reduces the system’s output,” says Chase Weir, CEO of Distributed Sun. “There is some evidence that new modules may be failing at increasing rates.”

A recent study by the National Renewable Energy Laboratory (NREL) indicated that more than 20% of all modules and systems it evaluated failed to produce the expected power output over time. An independent study by the website Solarbuyer found defect rates increased from near the 5% range in September 2011 to nearly 25% by February 2012. “These rising defect rates in new panels have the potential for longer-term implications for projects and failures after installation,” Weir says.

Intertek’s Rai says he’s been shocked by the number of calls he’s had from new system owners who are worried about their systems’ performance. His company has done much work to reassure investors.

“People have sent pictures to us from the field with solar-panel failures three years after the installation,” Rai says. “I don’t think there’s a big focus on the long-term failures because the industry is trying to save what they currently have in the ground now.”

Keep The Investors Happy

With more projects changing hands, some investors are taking a short-term view of the potential failures, putting them off on to the next owners, Rai says.

“They’re not worried about the long-term potential problems with a system and potential rip-and-replace costs,” Rai says. “They are calculating whether they can make their three-year, five-year or seven-year returns and how much they can sell the project for at the end. They’re saying, ‘Let that be the next guy’s problem.’ It’s an interesting attitude.”

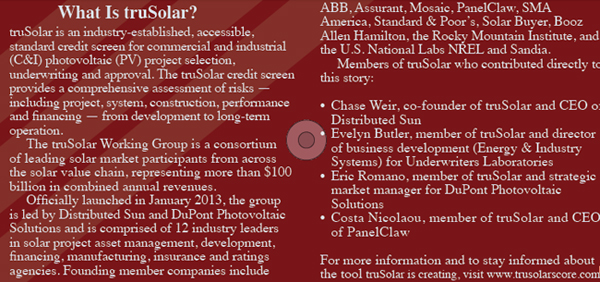

Weir, co-founder of industry group truSolar, says owners and financiers have difficulty making decisions about what technology to use without good screen tools that assess project, system, construction, performance and financing risks.

“Modules, inverters and racking that don’t perform as expected put investor confidence at risk and could have a negative affect on the industry at this critical point in its growth,” Weir says. “Current practices are clearly not sufficiently preventing reliability issues nor is the market-access testing intended to address reliability.”

The problem, according to Evelyn Butler, director of business development (Energy & Industrial Systems) for Underwriters Laboratories, is that current procedures were never designed to test reliability. New protocols are being developed, but this will take time.

“The new reliability-based standards need to be created in a way so the industry agrees on the science and application,” Butler says. “The better we can screen projects to minimize performance risk, the better we can support the continued growth of the industry.”

The rapid expansion of the industry in the past three years — 277% in total — has led to what Tom Tansy, chairman of the SunSpec Alliance, says is “irrational expansion.” Companies rushed products to market without doing the proper long-term testing. But there are ways to deal with that problem, he adds.

“When it comes to reliability, market forces — combined with an appropriate assignment of risk — tends to sort out the problem,” Tansy says. “Companies with poor quality tend to fail. There’s nothing new here. Companies with high quality tend to thrive.”

When Companies Disappear

Tansy is right about the market forces determining the winners and losers in this market. The increasingly rapid merger, acquisition and bankruptcy rate of solar manufacturers is proof.

Disappearing companies pose the biggest threat to consumer and financier confidence in the market. If homeowners install inverters or panels in good faith, only to have them fail and then discover the manufacturer is out of business, what do they do?

“Buying solar panels with a 25-year warranty from a three-year-old company that is fighting to survive in a rapidly consolidating market has questionable value,” says Eric Romano, strategic market manager for DuPont Photovoltaic Solutions. “When that happens, there is no recourse. It’s extremely difficult to get warranty remuneration when insolvency occurs or when performance issues related to early degradation occurs.”

Despite the challenges, truSolar’s Weir believes the solar industry can overcome them.

“We remain confident that an industry like solar, known for its innovations can overcome these challenges by working together,” Weir says.

The biggest issue for investors is price and not quality of the product. At least this is true for larger projects in Europe where everything began.

If investors buy cheap and in this case I mean products mainly from China, then who is to blame ?

If you buy high quality products with guarantees (and for this type of product one will also get insurance coverage for short production due to technical failures) then degradation will be 10 – 15 % in 50 years. Higher price but only a one time investment.

Clearly a paradigm shift in Solar, as existing, needs to occur at both the business model level and the delivered technology level and that change is arriving shortly.