By Andrew Alayza, director of marketing for Solstice

By Andrew Alayza, director of marketing for Solstice

Despite the threat from tariffs, data from the Smart Electric Power Association (SEPA) shows community solar capacity has doubled to 730 MW in 2017.

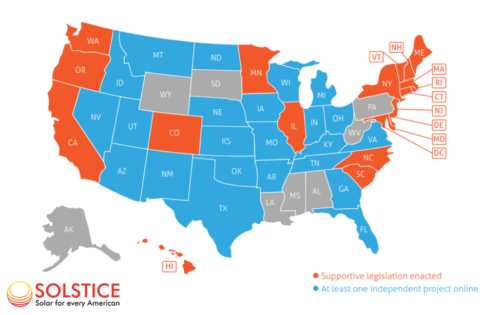

As of today, community shared solar is available across 42 states, yet you will find that contract terms vary widely from project to project.

The most common community solar contracts can fit under three main categories: ownership, long-term with a strict cancellation policy and short-term with a flexible cancellation policy.

Having led the marketing efforts at Solstice, a social enterprise that connects communities to a local solar garden, I have seen first-hand how the specific type of contract can have an enormous impact on the customer, the developer and the financier. But there’s a disconnect between the desires of those parties.

Short-term contracts with a flexible cancellation policy are by far the most preferred choice by customers. But financiers prefer long-term contracts with a strict cancellation policy.

Having reached more than seven million households across the U.S. and nearly every active community solar developer, we have discovered an ideal contract framework that allows developers and financiers to achieve their true growth potential.

The ideal community solar contract to bring solar to the masses

Contract length

Long-term contracts create an additional sense of security for solar developers and financiers that aim to minimize financial risks through low churn rates. However, filling subscriptions for long-term contracts can be a challenge.

With a smaller addressable market, acquisition costs will increase as it becomes harder to acquire and replace customers that are willing to sign up to a long-term contract.

In our experience, we’ve seen that 50% of customers will decline to join a community solar project due to its contract length.

For the customer, the ideal community solar contract would be one year long with the option to auto-renew at the end of each term.

This creates a safety net for subscribers by giving them a guarantee that their savings will stay consistent over a period. As seen through Ambit’s recent $9.3 million class-action settlement, consumers are appalled at the escalating teaser rates used by some energy service companies (ESCOs), which can sometimes double after the first month of subscription.

Delaware River Solar (DRS), a partner developer of Solstice, has a deep understanding that a customer-focused approach will allow it to capture a broader market share, more profit and faster growth over the competition. Our latest project with them offers customers a one-year term with flexible cancellation.

As of today, DRS has more than 30 projects in the pipeline, making the company a success story on how a consumer-centric approach in the community shared solar industry leads to higher profits.

Short-term contracts have the potential to increase the market size for developers, allow more projects to be developed and control acquisition costs.

Additional fees

By removing all additional fees like upfront costs and early cancellation penalties, developers can lower the barriers to entry for community solar subscribers.

By removing all additional fees like upfront costs and early cancellation penalties, developers can lower the barriers to entry for community solar subscribers.

Lower entry barriers make it easier for customers to subscribe to a project as the reward outweighs the perceived risks.

The easier it is for customers to subscribe, the shorter the sales cycle—making it much cheaper and simpler for the project owner or its customer management partner to find a replacement for a newly vacant spot.

The churn that results from one-year contracts with no cancellation fees is considerably lower than the waitlist that project can attract. The right customer management partner can easily replace routine customer churn with no additional cost to developers and financiers. At Solstice, I can personally say that we’ve seen minimal churn with one-year contracts.

Acquiring the right subscribers is a much more powerful way to prevent churn than steep cancellation fees.

Credit score requirements

80% of Americans cannot access rooftop solar, but community solar has the opportunity to reach these 90 million households. The total addressable market is much larger than traditional rooftop solar.

However, credit score requirements can shrink the pool of available households that can subscribe to a project. Therefore, it is important for developers and financiers to evaluate the impacts of credit score requirements on community solar projects

Data from the Corporation for Enterprise Development shows that 56% of consumers have subprime credit scores, and 14% do not have a credit score at all.

Imposing steep credit score requirements will exclude 70% of the population from community solar. Unfortunately, these are the people who need energy savings the most.

At the same time, the developer or financier establishes credit score requirements to ensure that subscribers pay their bills on time and do not default on any payments.

At the same time, the developer or financier establishes credit score requirements to ensure that subscribers pay their bills on time and do not default on any payments.

As a way to balance these two needs, Solstice has developed the EnergyScore—a more inclusive, accurate and scalable predictor of utility bill payment performance than a traditional credit score. This will allow developers to extend the opportunity to go solar to qualified low- or no-credit households while decreasing overall project risk.

The vast majority of community solar projects impose a 650 to 700 FICO score requirement on customers. Yet FICO doesn’t measure whether customers pay their utility, rent or cell phone bill on time. Millions of Americans with a FICO credit score less than 700 still pay these bills on time and would be reliable community solar customers.

Given that the EnergyScore is more accurate and more inclusive than FICO, the ideal community solar project will not have credit score requirements. Instead, the perfect project will adopt the EnergyScore as the primary qualification metric.

Amount of savings

Community solar projects are more lucrative for developers and financiers to build than other types of solar, which is why they can offer it as a cheaper power alternative compared to utility companies.

Based on one of our recent customer studies, people prefer to subscribe to a project with 10% savings rather than a project with a low single-digit savings percentage. This is the ideal balance between what can draw interest from a subscriber and what a developer can offer while remaining profitable.

One-year contracts are still new for community solar. While early projects show minimal churn, there is not enough data to build a model that predicts churn. The lack of long-term data creates uncertainty, and this poses a threat to the profits of the financier. For community solar to expand, this is a crucial problem that needs to be solved.

At Solstice, we want to achieve the ideal contract in a controlled way, and we strive to prove its results. To do so, we are looking for like-minded partners who are interested in developing innovative financing mechanisms to get to the ideal product offering: a contract that is scalable, replicable and profitable for all parties involved.

Tell Us What You Think!