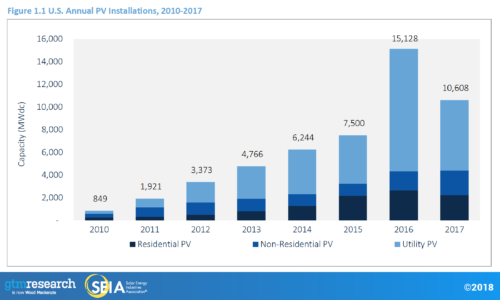

SEIA’s Solar Market Insight Report 2017 Year in Review found both residential and utility-scale solar numbers fell while one segment grew: non-residential solar, which consists of C&I and community-scale solar projects.

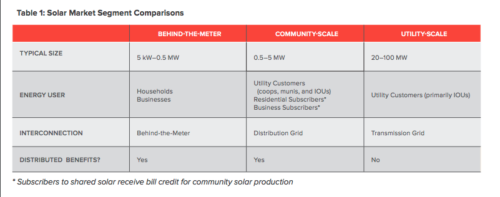

Community-scale solar projects fall between residential and utility-scale projects in size. These versatile projects can be owned by different stakeholders including communities, universities, municipal utilities, rural electric co-ops or corporations. Community solar is a type of community-scale solar project, but not all community-scale solar projects are considered “community solar.”

“We don’t care about the ownership structure—it’s all about the size of the system and that it goes close to load and it goes on the distribution grid,” said Thomas Koch Blank, principal at the Rocky Mountain Institute.

The advantage of this size of system is it can be located close to the distribution grid and thus close to load. Conversely, utility-scale solar must be located close to the transmission grid—and Blank said that space is limited.

“We are running out of large, flat fields of cheap land close to transmission grid,” Blank said. So for utility-scale projects, that means either an increase in land costs or transmission costs, which becomes effectively a disadvantage of scale.

Community-scale projects avoid these high transmission costs since they can be connected straight to the distribution grid.

RMI believes the community-scale market has a 20- to 30-GW potential in the next few years, but this segment needs help reaching its full potential. Some perceived barriers to development are cost, awareness and access for buyers to know how to purchase and finance these systems.

“What we’ve learned is that cost is actually not really a barrier because these systems are cost-effective. It’s just that people don’t know about it,” Blank said.

RMI created the Shine program to help educate stakeholders and overcome these perceived hurdles. In the program, RMI acts as a buyer’s representative for organizations, municipal utilities and rural electric cooperatives adopting community-scale solar.

“We’re trying to stay there at the forefront of markets that are just about to take off and kind of nudge them into self-growth,” Blank said.

So far, through Shine, RMI has issued an RFP for 15 MW of community-scale solar in New Mexico and received prices similar to the cost of utility-scale solar, and is also working on an RFP with ROCSPOT to cultivate community solar in Rochester, New York.

Tell Us What You Think!