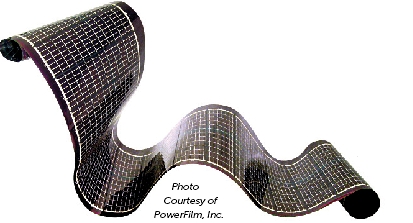

A thin semiconductor device deposited on a glass, plastic or metal foil substrate creates thin-film solar modules. Thin-film PV can be very thin, from 0.22 to 1.22 mm at one manufacturer, and very flexible. Its thin nature, light weight and flexibility lead to a variety of powering scenarios, from golf carts to remote government sites.

A thin semiconductor device deposited on a glass, plastic or metal foil substrate creates thin-film solar modules. Thin-film PV can be very thin, from 0.22 to 1.22 mm at one manufacturer, and very flexible. Its thin nature, light weight and flexibility lead to a variety of powering scenarios, from golf carts to remote government sites.

The most common semiconductors used in thin-film solar module production are amorphous silicon (a-Si), cadmium telluride (CdTe), and copper indium gallium di-selenide (CIGS). The first thin-film technology to be commercialized was amorphous silicon on glass, which was used to power small electronic devices such as calculators. This was extended to larger modules capable of a broader range of applications. Amorphous silicon on metal foil and plastic substrates entered the market later.

The thin-film layers in a module are typically deposited using a physical vapor deposition process. Glass plates are the least expensive substrate but require more sophisticated robotics, as large plates must be moved through the production process. Plastic and foil substrates are more expensive, but they can be processed in a roll-to-roll fashion, adding certain efficiencies to the production process. The use of insulating substrates, such as glass or plastic, allow higher working voltage modules to be created directly on the substrate with the use of laser scribing and printing. If a conductive metal foil is used as the substrate, cells must be cut out individually and interconnected in the same way that crystalline solar cells are integrated to create solar modules.

While these are the primary thin-film semiconductor materials currently in the thin-film PV marketplace, research efforts continue on alternative semiconductor materials, including dye-sensitized and other organic semiconductor material.

CdTe and CIGS are the most recent additions to the market, focusing on larger power applications. CdTe and CIGS were delayed in part because of the materials’ sensitivity to water, which necessitated packaging that provides an extremely strong moisture barrier. The highest volume thin-film technology at present is CdTe on glass. These are large glass plates used in power installations, much like crystalline silicon modules. A-Si and CIGS on flexible plastic or foil substrates have been applied to the building integrated market because they add very little weight to the existing structure and may be bonded directly to roofing materials with adhesive.

Production modules of all thin-film technologies have a lower output per unit area than crystalline silicon modules, but can be lower cost in dollars-per-watt (CdTe). Thin-film on flexible substrates (a-Si and CIGS) tend to be significantly lower in efficiency, but have advantages of flexibility, durability and low weight – giving them great benefits in certain markets. Of the thin-film technologies, CIGS has the highest laboratory efficiency, approaching that of crystalline silicon, but it’s low cell operating voltage and complexity of deposition causes typical production module efficiencies to drop to the range of other thin-film technologies. Material availability and cost also limit CIGS.

The recent global economic crisis and the continued decline in crystalline module prices from China have had a significant impact on the thin-film solar module landscape. In the large-power market, the only thin-film technology that can currently compete with crystalline prices is CdTe. Companies using this technology have survived, but not without erosion of profitability. Flexible thin-film companies focusing on the building integrated market have lost significant amounts of money with many filing for bankruptcy. Thin-film companies focusing on specialty or niche markets are surviving, but face limited growth.

The outlook for thin-film PV remains somewhat cloudy and fractured. In the large-power market, much depends on pricing of crystalline silicon from China. As the benefit of earlier subsides and favorable exchange rates fade over time, thin-film modules may become stronger players and eventually dominate this extremely large market. Warranty and lifetime issues remain a threat to thin-films in this market, as they do not have the years of field experience available to the crystalline silicon manufacturers. Erosion of the Chinese crystalline cost advantages may allow flexible thin-film to competitively re-enter the BIPV market. In any case, thin-films should remain a player in specialty niche markets though growth there is limited. It should be kept in mind that thin-film technologies are relative newcomers and there are always technical advances that could place them in an enhanced competitive position.

By: Frank Jeffrey, Co-Founder and CEO of PowerFilm, Inc.

Thanks for valuable info…