Feed-in tariffs (FIT) are a policy mechanism designed to accelerate investments in renewable energy technologies. Renewable energy producers are paid a set rate for the electricity they create, usually differentiated according to the technology used (wind, solar, biomass, etc.) and the size of the installation. FITs guarantee that anyone who generates electricity from a renewable energy source — whether a homeowner, small business or large utility — is able to sell electricity into the grid and receive long-term payments for each kilowatt-hour produced(1). This provides much needed investment certainty.

Payments are set at pre-established rates (often higher than market price) to ensure developers earn profitable returns, and FITs decrease at a designated rate over time. The compensation rate reduction for newly constructed plants (degression rate) is necessary and possible because the market growth is accompanied by a reduction in the costs of producing the systems with which power is generated. The faster the market grows, the more vigorously the compensation for new plants can be cut. Under the current German Renewable Energy Sources Act, for example, the annual solar degression rates vary from 8% to 10% a year, depending on market growth.

What is certain is that the degression curve can’t be too steep, so the compensation rates do not fall below the threshold at which a return starts to be earned in later years. Otherwise, investors in new manufacturing facilities would fear for the future of the sales markets they intend to target, weakening their readiness to invest.

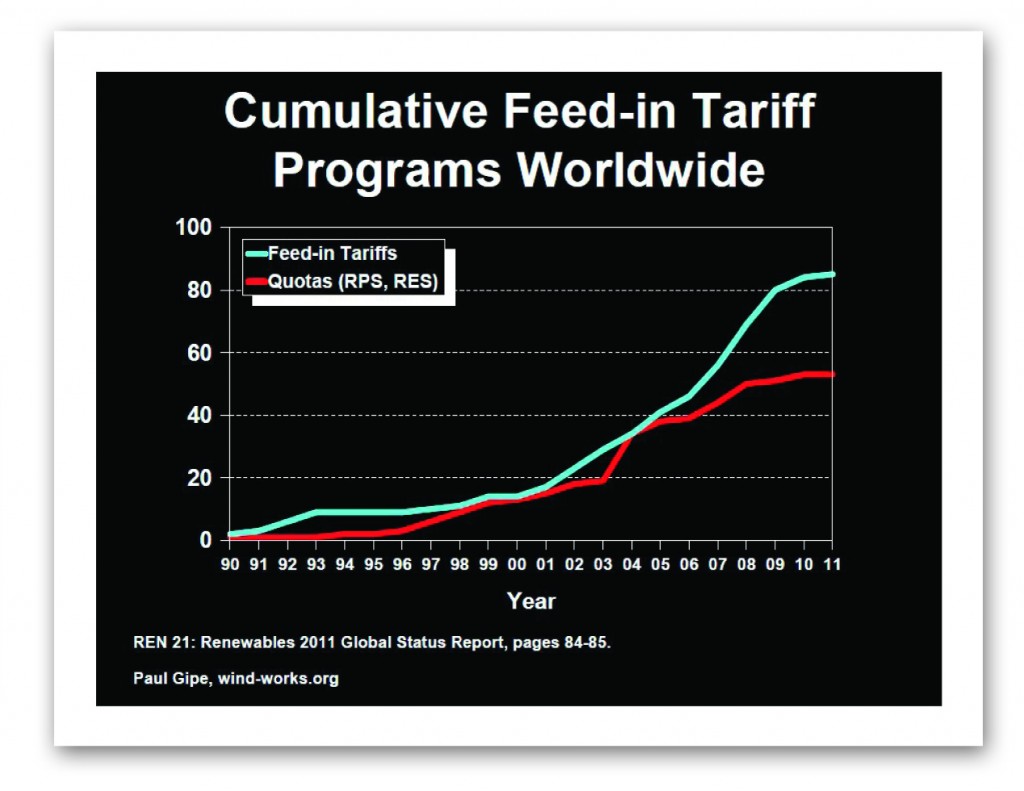

Over the past decade, the FIT is credited for the rapid deployment of wind and solar power among world renewable energy leaders Denmark, Germany and Spain. Similar policies have since been adopted by many other countries, making the FIT the most successful tool for promoting renewables. Because payment levels are performance-based, the incentive is placed on producers to maximize the overall output and efficiency of their projects.

To illustrate the effectiveness of the FIT in Germany, the installed capacity of German solar PV has increased from about 1 GW in 2004 (1 billion watts — roughly the output of a nuclear power plant) to over 26 GW at the end of 2011. While at the same time, the FIT price has decreased from over fifty to sixty euro cents per kWh to less than twenty euro cents per kWh. This is exactly what a well-designed FIT should do. It has worked as planned in Germany, a country with half the solar insolation (exposure to the sun’s rays ) of the United States.(2)

More than 80 jurisdictions around the world now use or have used FITs to pay for new renewable generation.(3) In fact, FITs now dominate policy for renewable energy worldwide, with 60% more jurisdictions — states, provinces and entire countries — using FITs than are now using quota systems such as Renewable Portfolio Standards or Renewable Energy Standards.(4)

The United States needs a nationwide FIT to kick-start the renewable energy industry, restore U.S. leadership in this market and accelerate expansion of the renewable industry worldwide. The rapid expansion of the renewable energy industry is a win-win for every country, for future generations and is a critical component to the long-term survival of humanity.

Why is a FIT critical?

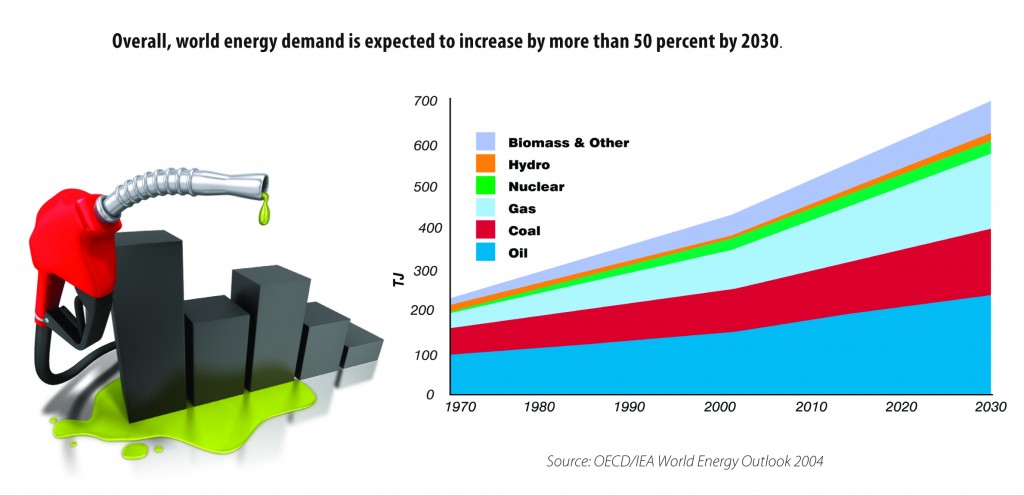

The world is running out of cheap fossil fuels. No other replacement source of energy abundant enough to sustain energy needs for more than forty or fifty years currently exists. If the United States were not running out of “cheap” fossil fuels, there would be no drilling for oil through 20,000 ft of water and then 10,000 ft of ocean bedrock to reach an oil field — an expensive, technically complex, dangerous and risky investment fraught with uncontrollable variables. Overall, world energy demand is expected to increase by more than 50% by 2030.(5)

Any attempt to understand or forecast global energy requirements must take account of population growth. At the beginning of the 20th century, world population was about 1.5 billion. Today, it’s more than 7 billion and growing at the rate of 90 million a year. By 2025, the world’s population is expected to reach 8 billion.(6)

The current world energy consumption rate is about 16 TW (a terrawatt is a trillion watts of power) per year. The direct solar energy that arrives on Earth during an average four-week period, (roughly 1,853 TW/yrs.) is greater than the total remaining reserves (1,755TW/yrs.) of all fossil fuels.(7) Clearly, the only current technically feasible, long-term solution today is renewable energy. Going forward, the strategy should be to accelerate the worldwide development of renewable as quickly as possible. By far the cheapest and only proven means to accomplish this is by establishing a nationwide FIT.

Key Benefits of FITs

•It is proven. Germany, a country that receives half the average insolation that the United States receives, set a 2010 target of 12.5% share of renewable energy in electric generation in 2000. In 2007, it surpassed that goal with 15.1%, 20% better and two years ahead of schedule. Since Germany has launched its FIT program, about 35 to 40 countries have followed suit and implemented FIT programs.

•It pays for itself in less than a year. In 2008, Germany’s additional cost for its national FIT was $3.2 billion euros. The German Federal Ministry for the Environment calculated the FITs return cost as:

• $7.8 billion euros from reduced amounts of fossil and nuclear fuels purchased

• $9.2 billion euros saved from the avoidance of external costs.(8) A total of $17 billion in savings for $3.2 billion in additional costs is clearly a superior return.

• The return-on-investment is independent of taxpayer funds. A FIT is not a subsidy, and no new public debt is needed to fund such a program, making it a stable and self-sustaining proposition in any economic and political environments.

• It decreases production costs and cost-per-watt installed.

• It encourages private investment, creates jobs, expands manufacturing and increases private-sector research and development.

• It dramatically reduces government bureaucracy and red tape associated with typical power purchase agreements (PPAs) by magnitudes.

• It enhances national security by lessening U.S. dependence on foreign oil, while helping to decrease the massive associated cash drain

Opposition to FITs

The No. 1 opponents of FITs are local electric utilities. These utilities argue that FITs work contrary to the market, which is a silly and inaccurate argument since most utilities are not driven by the market. They are monopolies and, by definition, do not respond to market forces. Positive results in a developed country like Germany show that FITs are far more market-oriented than monopolies.

Furthermore, powerful contributors, such as utilities and fossil fuel companies, do not want infringement on their businesses and will oppose efforts to kick-start an industry that will compete against them. But there is no economically valid opposition to FITs if the primary consideration is the lowest long-term cost, the welfare of the country and the long-term health of the planet.

Germany vs. The United States

The primary reason FITs are working in Germany — and not in the United States — is the respective mindsets in each country, evidenced in the following quotes:

We decided we will reduce the CO2 [by 40%] by 2020 [and 80%] by 2050. Then, we debated the instruments that could make this possible and decided on feed-in tariffs.

I hear arguments (spoken in 2009) we discussed in Germany 10 or 15 years ago. It’s the same debate. In Germany, we made a decision; we made a law….the renewable Energy Resources Act (FITs). It worked. You can see the results.

— Willi Voigt, former minister of the German state of Schleswig-Holstein, one of the early adopters of FITs.(9)

The Germans made a decision to benefit all their citizens and then followed through with it. The United States has not been able to make this kind of decision, despite the fact that every U.S. president since Richard Nixon has recognized the country’s unsustainable energy path and vowed to move toward less dependence on oil. In that time, the country’s oil dependency has more than doubled. Unlike other countries, America has taken a reactive stance in terms of energy, but the current, catastrophic trajectory of energy consumption demands a proven, proactive solution. Opponents of renewable energy — the fossil fuel industries and their Congressional cohorts — have strived to the energy crisis through the media and keep a critical and obvious solution (FITs) from reaching the American people.

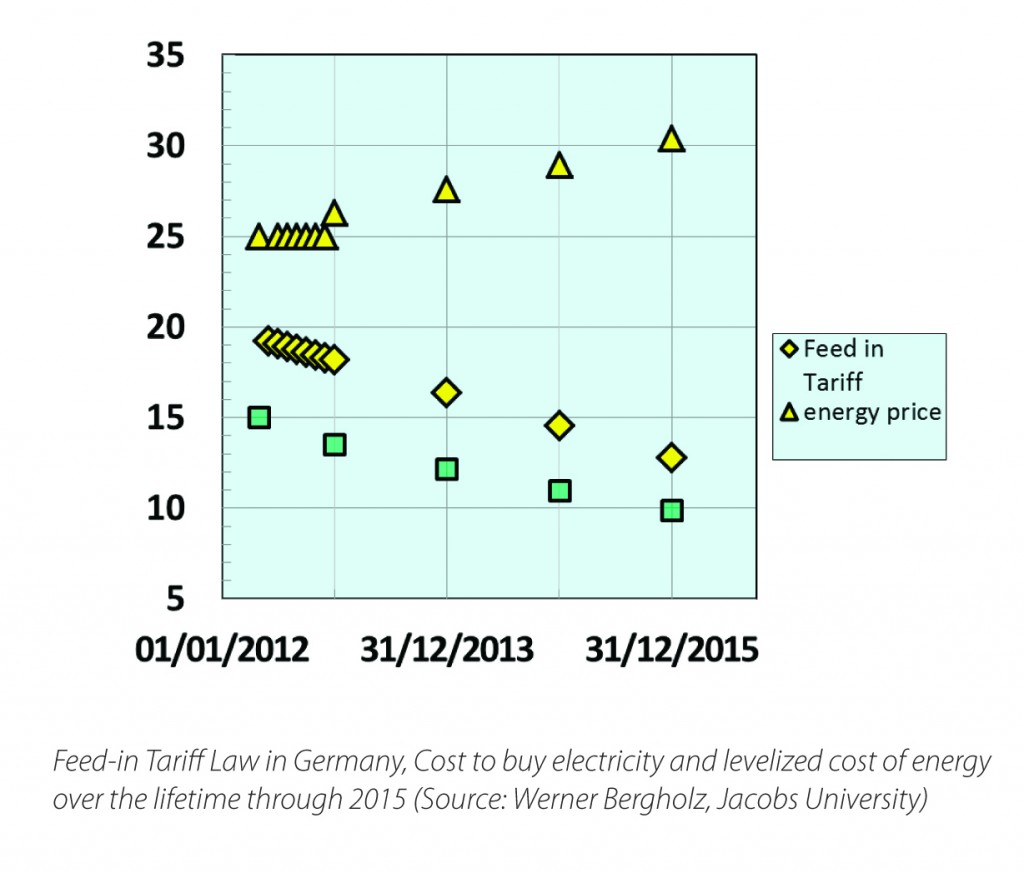

Feed-in Tariff Law in Germany, Cost to buy electricity and levelized cost of energy over the lifetime through 2015 (Source: Werner Bergholz, Jacobs University)

What would German installation costs mean for the U.S. solar market, where sunshine is more abundant? Americans could buy solar on long-term contracts, with no subsidies, for 18.6 cents per kWh in Minneapolis and just 15.4 cents in Los Angeles, not counting existing or future tax credits.(10)

FITs are not theories. They have been demonstrated and proven. They do not need further research, development or testing. In fact, FITs are currently operating programs that have been developed and honed in highly industrialized countries and in successful operation for more than 12 years. The United States can learn from the FIT in Germany, a country that was quick to recognize the transparency and effectiveness of a FIT.

It is interesting to note that in 2006 China avoided implementing a FIT, saying FITs triggered too rapid market growth. In 2011, however, the Chinese implemented a FIT program, and their domestic market is now booming with solar manufacturing having scaled up to where it can address this huge new market without reliance on imports.

A FIT program is the most effective way to spark rapid development of the massive renewable energy required to keep the United States going strong. Renewable energy projects in the United States have often met resistance from wary investors, but FIT policies remove uncertainty by ensuring that anyone with access to sun and wind can receive funding for a set period.(11)

The United States needs to stop the current politically distorted debate and start with real action. The time for talk is over. The time for FITs is now. SPW

End Notes

1 World Watch Institute; North American Feed-in Tariff Polices Take Off; http://www.worldwatch.org/node/6221; accessed July 20, 2012.

2 Deutsche Bank Group; DB Climate Change Advisors; 2011.

3 Gipe, Paul; Snapshot of Feed-in Tariffs around the World in 2011; Renewable Energy World; October 6, 2011;

http://www.renewableenergyworld.com/rea/news/article/2011/10/snapshot-of-feed-in-tariffs-around-the-world-in-2011; accessed August 7, 2012.

4 Gipe; October 6, 2011.

5 World Nuclear Association; Uranium, Electricity and Climate Change; http://www.world-nuclear.org/education/ueg.htm; accessed August 7, 2012.

6 World Nuclear Association

7 BP Statistical Review of World Energy 2008. Note: The direct sunlight number is from only land masses and is discounted 65 percent due to losses through the atmosphere and clouds.

8 Germany calculates the avoidance of costs related to using renewable energy vs. fossil fuels, such as: damage to climate, impact of air pollution and toxic wastes on health, and cost of cleaning rivers and other bodies of water. The US does not include such costs in project or technology analysis, which will result in enormous long-term negative impacts, as well as a significant additional burden on US taxpayers.

9 Lynch, Peter; Renewable Energy World, Feed-In Tariffs: The Proven Road NOT Taken…Why?; November 23, 2011; http://www.renewableenergyworld.com/rea/news/article/2011/11/feed-in-tariffs-the-proven-road-not-takenwhy; accessed August 7, 2012.

10 Farrell, John; Renewable Energy World; German Policy Could Make Solar in America Wunderbar; March 20, 2012; http://www.renewableenergyworld.com/rea/blog/post/2012/03/german-policy-could-make-solar-in-america-wunderbar; accessed August 7, 2012.

11 World Watch Institute.

By: J. Peter Lynch, an advisor to Principal Solar. Lynch is a pioneer in the renewable energy sector of the investment-banking industry and regarded as an expert in renewable energy. Peter brings a wealth of knowledge from his 35 years as a Wall Street security analyst, independent security analyst and private investor in small, emerging technology firms.

Check out Solar Power World’s Solar Speaks podcast with Peter Lynch to learn more!

Tell Us What You Think!